From mover to retail magnate: Sergei Galitsky opens up to The Bell

Sergei Galitsky spent 25 years building Magnit, Russia’s largest retailer, and has been hailed as the golden boy of Russian entrepreneurship. But then, a year ago, he suddenly sold the company to state-owned VTB Bank, refusing to talk to journalists. The market has always wondered what happened, but Galitsky remained silent. Until now. The Bell went to meet Galitsky in his home city of Krasnodar and has pieced together the compelling story of this unique businessman and his company. At its peak, Magnit was valued at $30 billion and was one of two blue chip stocks in Russia most loved by Western investors. How did Galitsky achieve such phenomenal success, and how did it all unravel?

A truck driver, banker, and sailor

By 1994, the 27-year-old Galitsky had already worked as a mover and a bank employee. He then took out a loan with his partners, and launched a wholesale perfume and cosmetics business, Transasia. The company grew quickly and in 1995 received the exclusive rights to distribute Procter & Gamble products in southern Russia. However, P&G required a separate company to sell P&G brands. Galitsky’s partners used Transasia for this while Galitsky created a new company, Tander, which would eventually become Magnit.

Retired sailor Vladimir Gordeichuk, who would rise to become the second in command at Magnit, began working at Tander as a truck driver. He joined the company as a driver in 1996, and then was given a local sales position, rising to become head of sales. Three years later, he was an executive director. Galitsky came up with the ideas, and Gordeichuk executed them. But Gordeichuk was also interested in philosophy: “I could be at work until 11pm, then get up at 4am, begin to read Hegel or Nietzsche, then go back to the office and at 9am call a team meeting for a group discussion. I tried to systematize things by employing a philosophical approach,” he said.

By 2005, Magnit, which was run out of the southern Russian city of Krasnodar (where Galitsky lives), had become (Rus) the country’s largest retailer by number of stores, but it was barely visible in Moscow and St Petersburg, where Magnit’s main rival, Pyaterochka, was expanding aggressively. “I don’t care where I make my rubles,” Galitsky said at the time.

From a managerial point of view, Magnit resembled an army and all decisions were taken at the highest level. During its period of rapid growth, this helped Magnit to open stores quickly: the company would just find a retail space of about 350 square meters, put up a cheap sign, paint the walls, and the store would open. No one could compete with them in terms of speed, recalled Ilya Yakubson, the former CEO of DIXY, another major Russian retailer.

Much of Magnit’s optimization was linked to technological innovation. The company built an IT system that automatically created orders for products in its distribution centers. Thanks to this technology, Magnit became one of only two Russian companies to be named (Rus) three times to Forbes’ list of the world’s 100 most innovative companies.

During all these years, there was something new every day, Galitsky recalled in his conversation with The Bell. “It was an unbelievable time, when you go to bed only in order to make the morning come sooner,” he said. “I didn’t eat breakfast at home at the weekend once during those 24 years.”

How Magnit became more expensive than Carrefour

The rapid growth required debt financing, but initially it was difficult for the company to find financial backers, recalls Magnit’s former financial director, Alexander Prisyazhnyuk. As the company grew, banks were more open to lending, but Galitsky didn’t want to take on too much debt. “I was never comfortable with a lot of debt: if EBITDA dips even a little, then you immediately have problems with the banks. Pyaterochka [whose primary shareholder was the powerful Alfa Group] could ask its shareholders for help, if necessary, but we didn’t have that option,” Galitsky explained.

Instead of taking on debt, Magnit went to the market. In 2006, the company did an IPO, and in 2008 and 2009, issued secondary share offerings. In just three years, Magnit had raised $1.2 billion. Investors believed in Galitsky: he could yell at them, bang his fist on the table, and disagree, but the company grew faster than its competitors, remembered one fund manager. Belief in Galitsky paid back handsomely: between 2006 and 2014, Magnit grew fifteen times to reach a valuation of $30 billion. In 2012, Magnit surpassed the world’s second largest retailer, Carrefour, in market capitalization — even though Magnit’s revenues were only one-tenth of Carrefour’s.

Galitsky was uneasy about the necessity to talk to the investors, the fund manager told The Bell. “He really disliked answering stupid questions posed by people who seemed to him to only look very superficially at his business.” In response to advice, Galitsky would say: “Guys, if you want to decide — sit in this chair and manage it yourselves. If not, then we will do what I say.”

Galitsky is distracted by soccer while managers squabble

On March 10, 2011, Galitsky burst into Gordeichuk’s office: “Did you read the news? Khasis is leaving!”, one of Magnit’s former managers recalled. The departure of X5 Retail Group’s long-time CEO Lev Khasis, who left the competing company to join Wal-Mart as a vice-president, was a big deal: Galitsky considered him to be a worthy opponent. And, perhaps inevitably, without Khasis, X5’s expansion stalled, and Magnit got a chance to grab the first place on the Russian market.

While there was a clear goal — to become the market leader — everyone at Magnit worked non-stop: the management team labored without weekends and each manager was expected to be always available. In 2013, the ultimate goal was reached (Rus) and Magnit overtook X5 to become Russia’s largest retailer by size of revenue. While victory was sweet, it also meant that Magnit lost an important stimulus for growth.

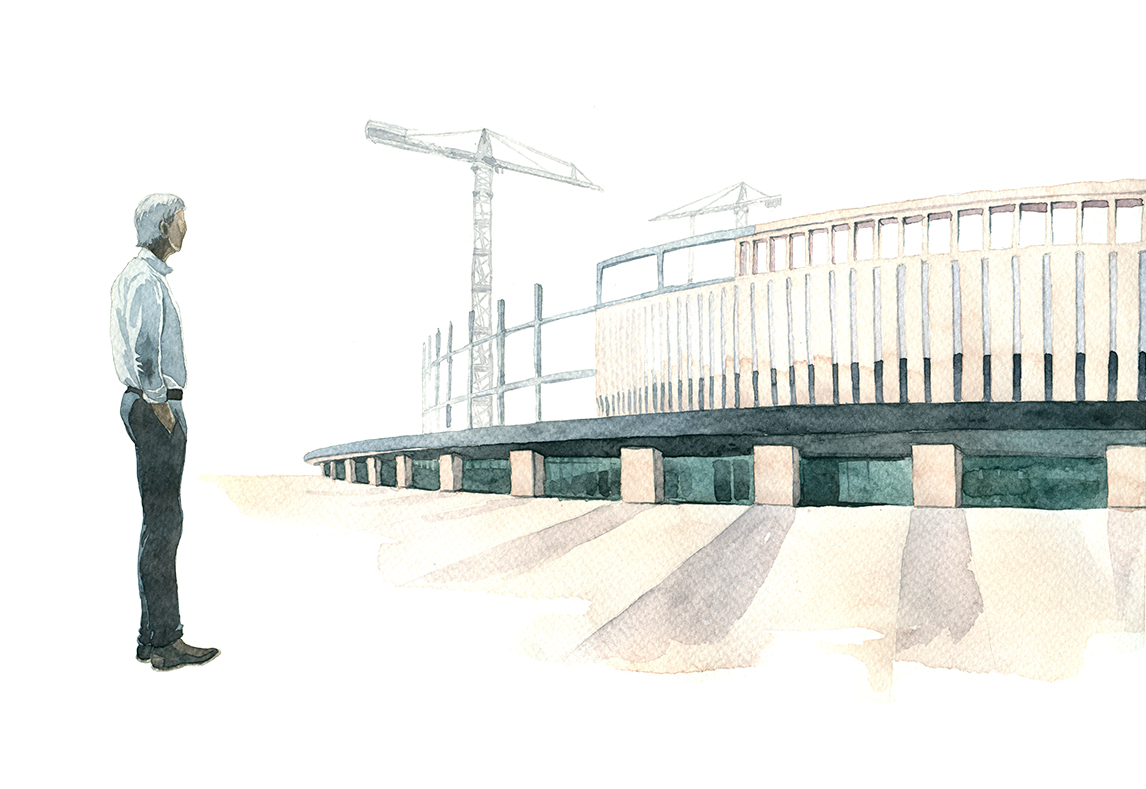

By this time, Galitsky was also deeply involved in another project: his soccer club, Krasnodar, which he had founded in 2008. “When we became the first, I thought, I can trust the managers more, make fewer decisions myself, and dedicate more time to football,” Galitsky remembers. Over ten years, Galitsky invested $400 million (Rus) in the club, and $90 million in a soccer academy. By 2013, Galitsky was involved in the construction of a modern soccer stadium in Krasnodar, on which he would ultimately spend 20 billion rubles.

Galitsky looks back on this period with regret: the more responsibility he passed to managers, the more apparent it became that company was too dependent on its founder. An investment banker recalled: “Magnit’s margins shrank pretty significantly [and] Galitsky said in conference calls with investors that you can’t turn your back on the company.”

The second in command at Magnit after Galitsky was still Gordeichuk. But by the end of 2015, Magnit’s managers began to notice that Gordeichuk, who was having serious family problems, was spending less and less time on operational issues. In early 2016, he left Magnit. The question of who would be responsible for operational management needed an answer, but Galitsky didn’t want to beyond the company. “To hire an outside manager to join such an entrepreneurial company would have been, in my opinion, like going to a casino and giving someone else your money,” he explained. In the end, Galitsky divided operational management between several managers. They quickly began to fight among each other, according to former Magnit employees.

“We probably became less hungry [for success], and somewhere along the way the ambitions of certain managers became more important than the end result,” Galitsky explained. “I probably should have been tougher.”

How Magnit slipped in the rankings

Household incomes stopped growing in 2014, but Russia’s retailers didn’t stop expanding: the battle for each customer just grew more intense. In 2013, X5 found the CEO it needed in Olga Naumova, who took over the helm of Pyaterochka. She began a huge store refurbishment programme which took (Rus) almost five years and cost (Rus) 38 billion rubles ($1 billion then). X5 installed automatic doors, extended windows, put in new lighting, and introduced fresh groceries. ‘They will never make the investment back, no one needs it,’ was what many thought, according to Yakubson, the former DIXY CEO. “But then we suddenly realized that Pyaterochka has created a new customer experience and the rebranding started to pay off.”

Magnit didn’t anywhere near as much money on its stores. “People don’t consume food, they consume calories,” Galitsky repeated over and over in interviews, emphasizing that Magnit serves the 80% of the population that spends no more than $200 per month on food. Yet now, Galitsky gives his competitor credit. “Pyaterochka became more aggressive and precise, it redid the stores, began to do what was right, at least in Moscow” he said. “But for me, profit was always more important than revenue.” But for investors, potential growth was the priority. In 2016, Magnit’s revenues grew just by 12.8 percent, compared to its usual 20 to 30 percent annual growth and, in the summer of 2017, half year results showed revenue growth of 6.4 percent. Funds began to sell their Magnit shares. During the second half of 2017, Magnit lost half its value and its market capitalization dropped below 500 billion rubles ($8 billion).

‘A gladiator should leave on time’

“We were a little bit tired, slightly burnt out,” Galitsky said of that period. In the summer of 2017, he realised it was time to take back control, and he went back to working seven days a week, one acquaintance recalled. But half a year later, he sold the company to VTB.

Galitsky’s acquaintance said the deal was agreed very quickly. “Why VTB? Because they sold several offerings of Magnit [equity]. The sale of such a major company is not a simple thing, and VTB was one of the few who he trusted,” the acquaintance said. The deal was agreed with unusual speed, explained an investment banker familiar with the details of the deal: for this reason, it took a long time (Rus) to close.

Galitsky declined to discuss the details of the VTB deal, but he talked about his reasons for selling the company in detail. Constant stress was one of three reasons that, he said, drove him to sell. “The company was very strongly associated with me personally. There were 6,000 vehicles on Russia’s roads every day. No matter what I did or didn’t do, there was a very high risk of a serious accident. You can’t control a situation 100%, and that ties you to people’s lives,” Galitsky explained. He tried to fight against this: he installed CCTV systems in his trucks, cars, stores, and distribution centers, but he still didn’t feel he had total control.

Age was another reason, Galitsky admitted. “With time, I began to slow down,” he explained. “Business is a game of intellect, and you have to admit that what you can do at 35 or 40 you simply can’t do at 50. It’s really difficult to face. In ancient Rome, they believed that every gladiator should die at the right time and with dignity.”

Finally, the bigger Magnit grew, the more the company came into contact with the state. “It’s not just in Russia: look at Facebook — its CEO testifies before Congress, is forced to explain himself there, this is the fate of all big companies,” Galitsky said. “When you are focused every day on finding optimal business solutions, but you have to spend more and more time on a dialogue with government agencies… that is very difficult… it’s not my strong suit.”

What next?

Eventually, Galitsky sold his 29.1% stake in Magnit to VTB for 138 billion rubles ($2.1 billion). At the press conference announcing the deal, he appeared to choke up and when he left the Magnit offices for the last time, employees turned out in their hundreds to applaud. Now, a year later, he said he does not have plans for a new business venture and he wants to spend his money in Krasnodar. His next project is a city park near his soccer stadium with 2,500 trees brought from Italy and Germany. “If I achieved success in this city and with these people, I should spend that money responsibly, and this requires no small part of my life. Otherwise, there would have been no point in making the money,” he explained.

After Galitsky’s departure, Magnit lost another 27% of its value. The company got a new co-owner: Alexander Vinokurov, the founder of investment outfit Marathon Group, and son-in-law of Foreign Minister Sergei Lavrov. The company’s new CEO is Olga Naumova, formerly of Pyaterochka, who is rebranding Magnit’s stores. Magnit’s revenues grew by 8.2% in 2018, but net profit and EBITDA both fell.