Keynes in jackboots: can defense spending sustain Russian economic growth?

Hello! This is Alexandra Prokopenko with your weekly guide to the Russian economy — brought to you by The Bell. I am joined this time by analyst Alexander Kolyandr to look at the structural transformation of the Russian economy amid the Ukraine war and what it has to do with economist John Maynard Keynes. We also discuss a rapid escalation in the confrontation between mercenary group Wagner and the Defense Ministry, the FATF decision not to blacklist Russia, Secretary of State Antony Blinken’s visit to China and the latest round of European sanctions on Russia.

Defense spending is buoying the Russian economy

Speaking at the St. Petersburg International Economic Forum earlier this month, President Vladimir Putin boasted that Russia’s economy will grow up to 2% this year. He put this down to Russian businessmen bringing capital home. But the other reason for such significant growth is rising government spending, particularly on defense and welfare. Russia’s economy is currently growing about 0.6% a quarter, never mind a country that has been hit by over 13,000 sanctions.

As sanctions have isolated Russia from the global financial system it is much better protected from external shocks and — barring a catastrophic event — Putin’s prediction is likely to not be far from the mark. However, this “success” has little to do with Russian business — it’s far more connected with Ukraine’s refusal to surrender, the ongoing fighting and the principles of celebrated British economist John Maynard Keynes.

What’s going on?

In the first quarter of this year, Russian GDP contracted 1.9% compared with the equivalent period last year. At the same time, seasonally-adjusted disposable income for Russians ticked up 0.1%. This is similar to other periods in the post-Soviet economy (notably in the 2000s and between 2010 and 2013) when citizens grew wealthier at a faster rate than the economy. Today, it seems, the reason for this unusual divergence is the war in Ukraine, or more accurately, what might be termed “military Keynesianism.”

Broadly speaking, Keynes suggested that economic growth can and should be stimulated by increased demand — when people have more money, they will spend more and generate demand which leads to economic growth. Money can be distributed (as in petro-states); it can be handed out through state assistance and employment programs (as in many capitalist nations). It can also be distributed with the help of a war (for an unusual explanation of Keynesianism, have a look at this rap battle).

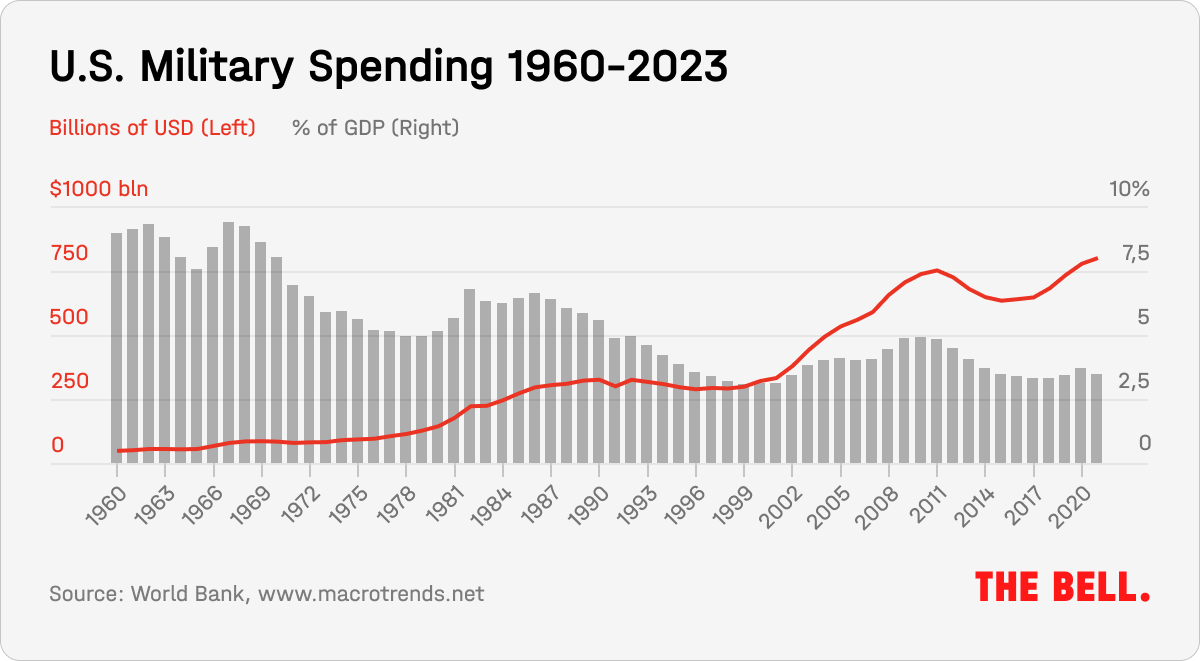

Military spending is one of the main expenses for Russia this year. Expenditure on “national defense” and “national security” is set to exceed 9 trillion rubles (6.2% of GDP), almost a third of total spending. Even so, this is not much for a country at war: at the height of the Vietnam War, U.S. military spending was 9.7% of total spending, during the most expensive period of the arms race in the mid-80s it hit 6.8% and, during military operations in Iraq and Afghanistan, it was at roughly the level we see in today’s Russia.

Powering the military

The money Russia has earmarked for this year is being spent extremely rapidly: in the first five months of the year, almost 60% of defense spending and almost 40% of security spending had already been carried out (this data comes from open sources — but on Wednesday the Finance Ministry announced it was ceasing publication of such information). In addition, there is a huge amount of construction underway in the Russian-occupied areas of Ukraine, which is all heavily subsidized. As much as 88% of the spending by the Russian-installed administrations in the four Ukrainian regions annexed by Russia last year is from Moscow, according to Ilya Tsypkin, an expert at Russian credit rating group ACRA.

Information on industrial output and data on greenhouse gas emissions provides further proof of the immense role of defense spending in Russia’s growing economy.

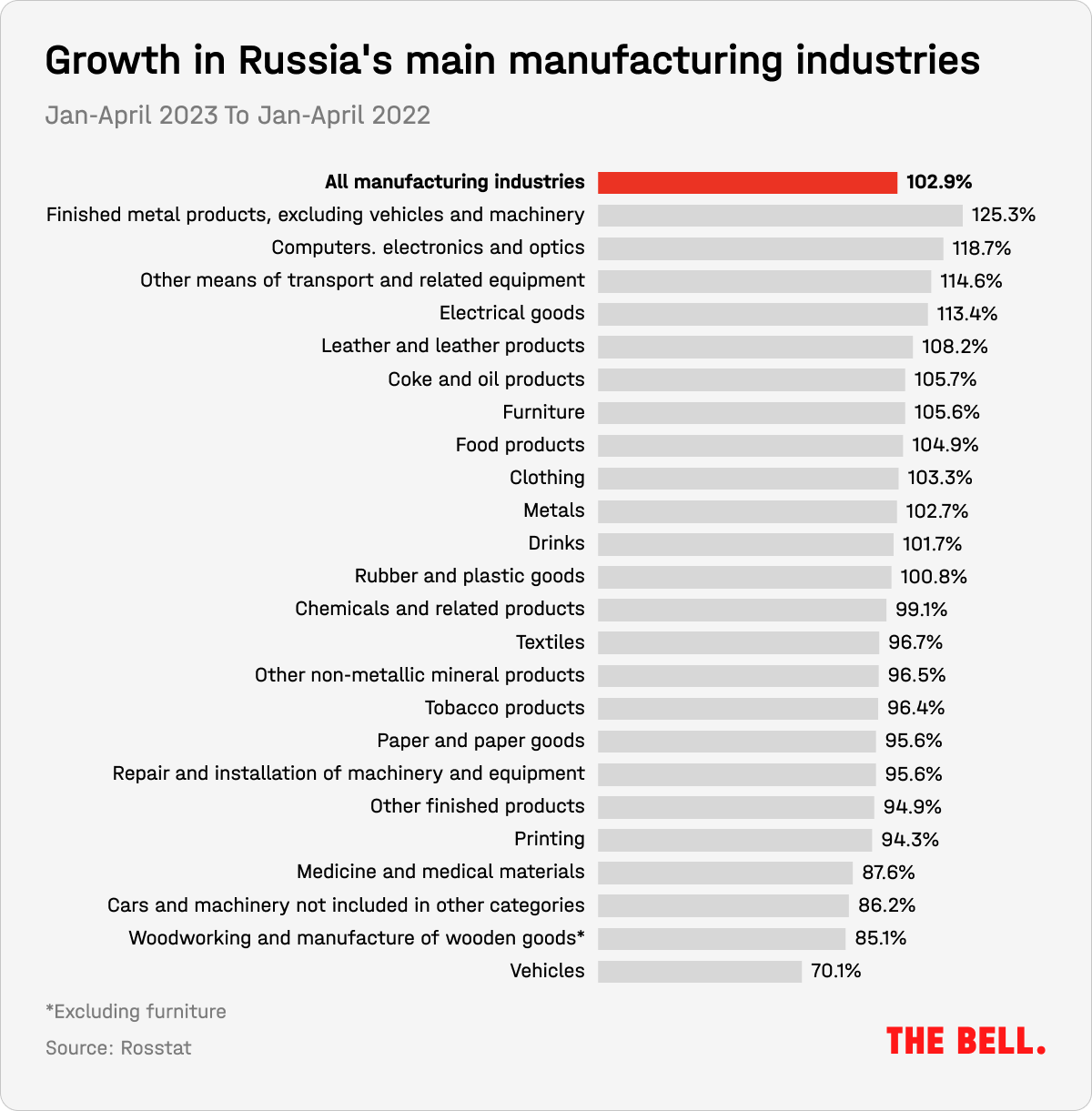

The defense sector has grown 25% between January and April, according to a recent Rosstat report. Production of electrical equipment in the same period was up 29%, motor vehicles by 27%, computers by 23% and optics and electronics by 23% (this includes military electronics and optics). Some product groups showed explosive growth: navigation devices were up 60% and specialized workwear rose 47%. Compared with the first four months of 2022, production of leather goods was up 8.2%, clothing was up 3.3%, vehicles and equipment up 14.6%, finished metal products climbed 25.3%, electronics and optics grew by 18.7%, and electrical equipment rose 13.4%. Output fell in sectors with no obvious military connections like textiles, tobacco, paper, wood products and mineral fertilizers.

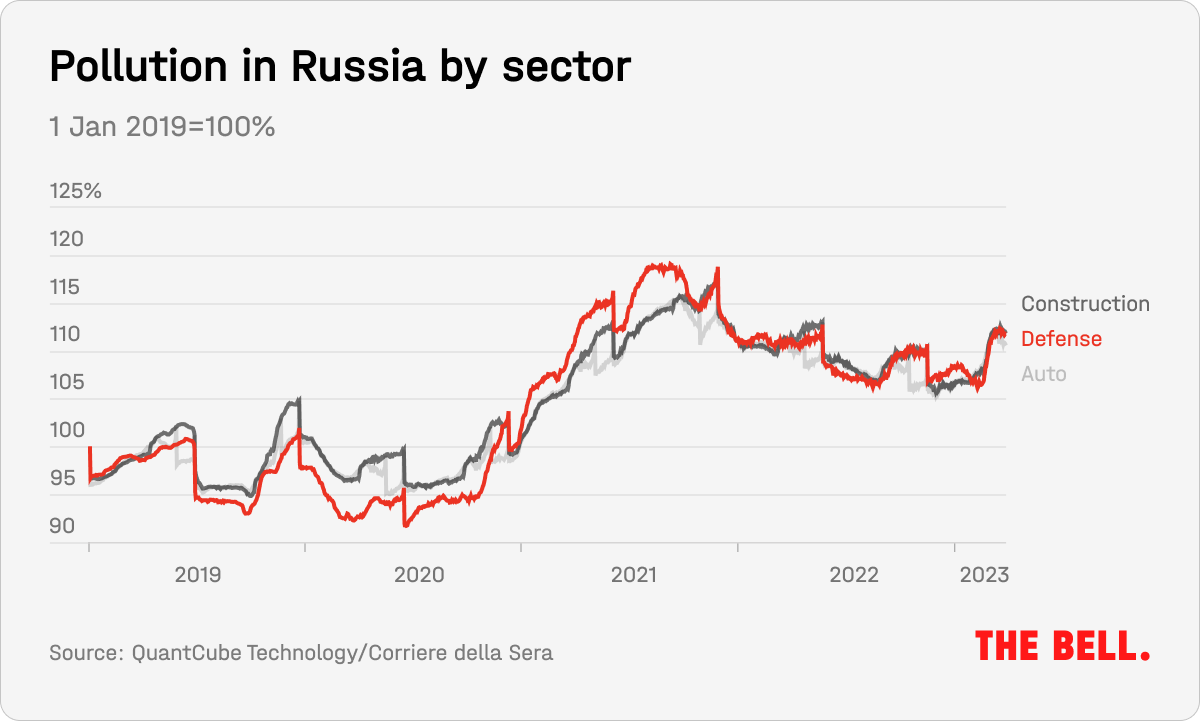

Greenhouse gas emissions are another indicator of increased industrial activity. Data on emissions prepared from QuantCube Technology, a Paris-based provider of data sets, and shared with The Bell by our colleagues at Corriere della Sera clearly shows activity in the defense sector last year outpaced activity in the construction and mechanical engineering sectors.

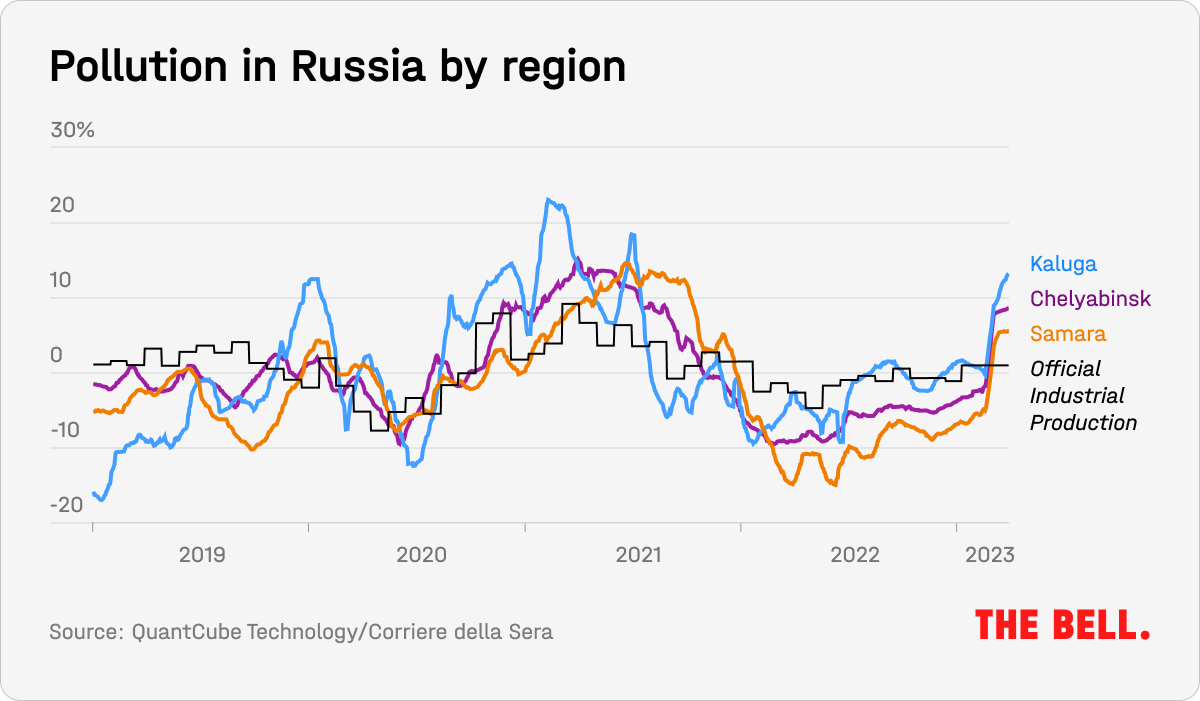

Emissions were noticeably higher in regions with lots of military factories – for example, Kaluga, Samara and Chelyabinsk.

Beneficiaries of the war

As well as supporting the economy, rising military expenditure also lines pockets. Official figures show that real incomes are rising fastest in regions with significant military industries, or from where there are large numbers of soldiers (Buryatia, Chechnya, the Jewish Autonomous Region, etc). Average incomes in the last quarter of 2022 grew faster among the poor — the higher the income bracket, the slower the salary increases have been (you can read more about the dynamics of Russian incomes here).

In this way, the war, like the Soviet-era arms race, has created its own group of beneficiaries: from workers in military factories to contract soldiers from poor areas. Due to Russia’s half-closed borders, the domestic tourist industry has been another beneficiary and expects significant growth this year. Increased state support for poor regions via military and social spending reinforces “social stability.” All this helps preserve a sense of normality, according to geographer Natalya Zubarevich. Some even believe that the economic beneficiaries of the war are already forming a new Russian “middle class.”

Why the world should care

The problem with this military Keynesianism, as we saw in the Soviet Union, is that it leads to reduced spending on non-military activities, lower productivity due to reduced competition, disruption to education, rising corruption and higher risks of a military escalation. It incentivizes the Kremlin to drag out the war as long as possible, or convert a hot war into a cold one. Sanctions have already limited Russia’s access to a range of advanced technologies and reverting the economy back to a civilian footing will not be easy. The longer economic growth is field primarily by defense spending, the greater the hangover will be when the time comes to again prioritize civilian production.

Prigozhin promises ‘retaliation’ after alleged attack on Wagner camp

Wagner leader Yevgeny Prigozhin announced on Friday that the Defense Ministry had carried out a missile attack on a camp belonging to the mercenary group and caused numerous casualties. The Defense Ministry denies the claim. In several voice messages, Prigozhin said Wagner would retaliate. The Federal Security Service (FSB) has reportedly initiated proceedings against Prigozhin for attempted mutiny. Putin's press secretary, Dmitry Peskov, said the president had been informed. Nevertheless, there is no reliable information about what exactly Prigozhin intends to do. As of 23:30 p.m.Moscow time there was no confirmation of Wagner troop movements, or any reports of armed confrontation between Wagner and regular Russian soldiers. In recent months, Prigozhin has regularly accused the Defense Ministry of incompetence — although he has notably refrained from criticizing Putin personally.

Blinken’s China visit not a game-changer

U.S. Secretary of State Antony Blinken described his trip to China as an attempt to identify conflicts and establish where the two countries are in agreement. In effect, it was an effort to prevent relations deteriorating further. Blinken spent seven-and-a-half-hours with his counterpart Qin Gang and three hours with Wang Yi, who is responsible for the Chinese Communist Party’s foreign policy (and is more senior than Gang).

One of the main obstacles to the stabilization of relations is the lack of channels of communication between the military, writes Alexander Gabuev from Carnegie. So the stability of relations between the two superpowers could at any moment be in the hands of a fighter pilot or a destroyer captain

At the talks, Blinken once again reaffirmed U.S. support for the “one China” policy and heard further assurances that Beijing would not supply weapons to Russia, nor become a proxy to help Moscow evade Western sanctions. For Russia, however, Blinken’s visit was also a success. The fundamental relationship between China and the U.S. has not improved — which means Beijing’s partnership with Russia will likely only get stronger.

EU agrees 11th round of Russia sanctions

The European Union has finalized its 11th round of sanctions against Russia. The most important new measure is a mechanism (as always, unanimously agreed by all 27 member states) banning the export of dual-use sanctioned goods and technologies to third countries if there is reason to believe that these will be sent on to Russia.

European officials have named Armenia, Kyrgyzstan and Kazakhstan as countries arousing suspicion of such behavior, along with the UAE, Turkey and China. EU foreign policy chief Josep Borrell mentioned Kazakhstan as an example of a country assisting Russia in possible sanctions-dodging: in 2022, vehicle exports from the EU to Russia fell 78%, while vehicle exports from the EU to Kazakhstan rose 268%.

FATF refrains from blacklisting Russia

Just as The Bell predicted, the international Financial Action Task Force (FATF) on Friday stopped short of adding Russia not only to its blacklist — but even to its “gray” list of countries with serious compliance issues. At a meeting, FATF confined itself to a reiteration of its plea for vigilance to those countries working with Russia. They also confirmed Russia’s suspension as a FATF member would continue to stand. So, Russia avoids any new restrictions. But things might change before the next FATF meeting, which is scheduled to take place in October.

Key figures

- Weekly inflation in Russia slowed to 0.02% (from 0.5%) between June 14 and June 19, according to the Ministry of Economic Development. Meanwhile, annual inflation continues to accelerate, rising from 2.87% to 2.96%. On June 19, prices were up 0.22% from the start of the month and 2.16% since the start of the year.

- The economy is growing, but business expectations are deteriorating, according to a survey carried out by the Central Bank in May. The “current state index,” which measures how demand and production have changed in the past month, rose to its highest level since June 2008. However, the “index of short-term expectations,” which measures expected change in demand and production over the coming three months, fell to its lowest level since December. It’s the second month running that this measure has fallen.

What to watch next week

- Inflation expectations and consumer confidence report (Central Bank, June 26)

- Research on Russians’ attitude to payment systems (Central Bank, June 28)

- Industrial output figures for January through May (Rosstat, June 28)

- Weekly inflation (Rosstat, June 28)

- Report on the socio-economic situation in Russia between January and May (Rosstat, June 28)

Further reading

Keeping America close, Russia down, and China far away: How Europeans navigate a competitive world by Jana Puglerin and Pawel Zerka

Tatiana Stanovaya explains why As Ukraine’s Counteroffensive Gets Under Way, Putin’s Calm is Just a Front

Divided Nation Maxim Alyukov on why Kremlin propaganda aims to polarize rather than persuade

The author of this newsletter is one of Russia’s leading writers on this topic: independent economic analyst Alexandra Prokopenko. Alexandra worked as an advisor at Russia’s Central Bank and Moscow’s Higher School of Economics from 2017 to 2022 — and before that she was an economic journalist for Vedomosti, then Russia’s leading business newspaper. Today, Alexandra works as a researcher at Center for East and European Studies (ZOiS) in Berlin a non-resident scholar at the Carnegie Endowment for International Peace and a visiting fellow a the Center for Order and Governance in Eastern Europe, Russia, and Central Asia at the German Council on Foreign Relations. She holds an MA in Sociology from the University of Manchester.