Putin returns empty-handed from Beijing

Hello! This is your weekly guide to the Russian economy — brought to you by The Bell. Our top story is about Putin’s trip to Beijing and why he failed to land any major economic agreements. We also look at whether Russia stands to make money from the Israel-Hamas war in the Middle East — whether via equipment sales or oil price rises.

Propaganda fanfare, but no economic deals as Putin visits Beijing

Russian President Vladimir Putin this week traveled outside the former Soviet Union for the first time since the International Criminal Court issued an arrest warrant for him in March. Putin was attending the Belt and Road summit in Beijing, an event accompanied by great propaganda fanfare. However, despite much back-slapping about the Sino-Russian partnership, no major economic agreements were signed.

- Most significantly, just as in his previous meetings with Chinese premier Xi Jinping, Putin was unable to secure any agreement on constructing the long-awaited Power of Siberia 2 gas pipeline that will export Russian natural gas from the Yamal Peninsula in Western Siberia to China. Six months ago, after meeting Xi in Moscow, Putin asserted that “practically all the parameters” of the project had been agreed, and all that remained was to ink the contracts. This sounded like wishful-thinking at the time, and so it proved to be. Despite the political and propaganda value of sealing such a deal, there was no mention of it in Beijing this week. Apparently the two sides are still haggling over the commercial elements of the deal – price formulae, supply volumes and mandatory purchase levels (take-or-pay).

- Energy expert Sergei Vakulenko, a nonresident scholar at the Carnegie Russia Eurasia Center has shown that even the first Power of Siberia pipeline, launched in 2014 and negotiated when Russia was in a far stronger geopolitical position, has not been a hugely profitable project for Moscow. The terms for this pipeline were less lucrative than Russia’s gas exports to Europe — and even Central Asian gas suppliers to China had a better deal. Russia has never officially disclosed the details of that deal.

- However, while Russia needed Power of Siberia 1 as a political project, now, with no way of selling to Europe, China is its sole remaining market for Yamal gas. New LPG has also arrived on the market. This all weakens Moscow’s negotiating position. With its strengthened hand, China apparently expects a significantly reduced price.

- Despite its political value to Russia, an agreement is unlikely to be signed anytime soon. “Right now, China has no urgent need to sign up to a gas agreement. There is no risk that Russian gas will be bought by someone else. Also, there is no risk that Russia will need time to fully develop the field — gas from Yamal can go to China in almost full volumes as soon as the pipeline is ready,” Vakulenko told The Bell. “For China, it’s worth waiting a couple of years before agreeing on a price – in that time new volumes of LPG from Qatar and the U.S. will come onto the market and we can expect global prices to fall. It’s better to negotiate a price in those circumstances.”

- Even if a new pipeline to China is eventually brought online, it will not mean Russia is able to replace the approximately $20 billion a year it used to earn from gas exports to Europe. Neither the price, nor the volume, of new gas supplies to China would compensate for the European revenues lost after the full-scale invasion of Ukraine. In 2019, Russia exported 165 billion cubic meters of pipeline gas to Europe and Turkey. The potential capacity of Power of Siberia 2 would be 50 billion cubic meters of gas (and it would be sold at much lower prices than for European contracts).

Why the world should care

The Power of Siberia 2 saga illustrates the extent of Russia's growing dependency on China. Moscow and Beijing might like to present their relationship as a partnership of equals, but it is Beijing that holds the economic trump cards.

Can Russia make any money from war in the Middle East?

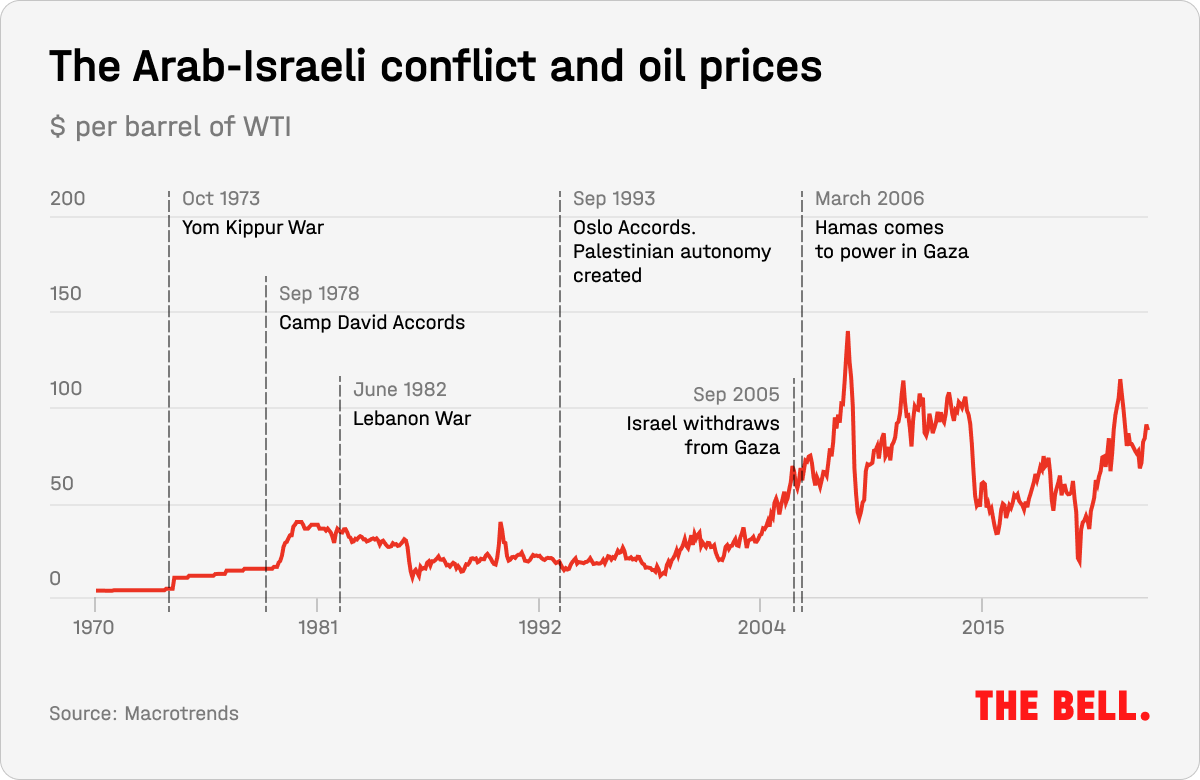

The fighting between Israel and Hamas has already given Russia a significant, unexpected political boost, with The Financial Times describing how it has “poisoned” the West’s united front in support of Ukraine. But could Russia also make financial gains from the current conflict? History suggests that such an opportunity might, indeed, present itself.

- The 1973 Yom Kippur War between Egypt, Syria, and Israel was good news for the Soviet Union. First, the Egyptian and Syrian armies purchased large amounts of Soviet equipment; after their defeat, they required Soviet support to rebuild their shattered military and civilian infrastructure. This time, however, all of that is impossible as Russia neither has the firepower, nor the workforce, to spare.

- But the Soviet Union also profited from that war in the Middle East thanks to the oil market. There was no direct threat to the oil infrastructure in 1973 (nor is there today: Israel is not a major oil producer). However, in 1973, supplies were hit when Arab states imposed an oil embargo on the U.S. and other countries including the Netherlands, one of Europe’s biggest oil hubs, as the fighting raged. This time, it’s only Iran that is calling for a similar embargo. Oil cartel OPEC, led by Saudi Arabia, seems to be ignoring that call for the time being.

- Oil supplies from Iran are not a significant part of the oil market (Iran sells most of its oil to China). Even if the U.S. wanted to stop Iranian oil shipments as a punishment for Tehran’s backing of Hamas, somebody would need to physically stop the ships — and there is unlikely to be the political will for a step like that. Thus, there are no real threats to oil supplies at the moment. The risks would rise, however, if more countries were drawn into the fighting.

- So far, oil prices have shown only moderate increases in the wake of the Hamas attack on Israel, and the subsequent Israeli strikes on Gaza. It’s likely there would be a similarly muted market response to the start of a ground offensive into Gaza. For the moment, prices are significantly lower than even last month’s peaks; never mind the inflation-adjusted spikes of 1973.

- As a result of the Yom Kippur war and the oil embargo, the Soviet Union profited immensely from a fourfold surge in global prices. The 1970s oil shock fuelled almost a decade of relative prosperity in the Soviet Union. Today, Russia cannot count on either a sudden price hike, nor the opportunity to earn significant cash from oil price fluctuations. The European embargo on Russian oil and the Western price cap have left Russian exporters dependent mostly on buyers in China and India.

Why the world should care

Traders say that events in Israel have brought the “Middle East factor” back into oil pricing after years of relative peace in the region. However, unless the conflict draws in other countries, the markets do not expect significant oil price rises — which means there are few economic benefits for Russia in the current situation.

Key figures

The Central Bank has published its latest macroeconomic survey of 31 economists who follow Russian markets. The results reflected the impact of high inflation in September and a lack of market faith in the capital controls imposed to stabilize the ruble. The median prognosis for inflation this year was up 0.7 percentage points to 7%. The projected exchange rate also got worse, with economists now expecting it to stay between 94-98 rubles to the U.S. dollar until at least 2026. This means monetary policy will have to keep tightening: analysts now expect interest rates to reach 15% by the end of the year (they’re currently at 13%). Finally, the consensus view for unemployment (3.5% by 2026) suggests that economists don’t expect any imminent labor market easing. This is the underlying factor for many of the current disbalances in the Russian economy.

Weekly inflation in Russia dropped to 0.15% in the week ending Oct. 16, according to the Ministry of Economic Development. Prices have risen 0.45% in the first two weeks of October, and 5.07% so far this year.

Further reading

Russia’s Sarmat Missile Saga Reflects an Industry in Crisis

Jake Sullivan’s Trial by Combat. Inside the White House’s battle to keep Ukraine in the fight.