Russia has too few workers

Hello! This is Alexandra Prokopenko with your weekly guide to the Russian economy — brought to you by The Bell. In today’s newsletter, we focus on the dynamics of the Russian labor market where there is a growing staff shortage. We also look at how Russia became the biggest foreign investor in Iran.

Increasing wages, falling productivity: Russia’s labor market contradictions

Russian leaders talk proudly of record low unemployment, arguing this demonstrates economic resilience in the face of Western sanctions. However, the headline figures mask a desperate labor shortage that is forcing companies to increase wages as productivity falls.

What’s going on?

Unemployment in Russia last year fell to a record low of 3.7%, Prime Minister Mikhail Mishustin proudly told parliament on Thursday. Officials love to brag about unemployment stats and the government insists that the labor market is stable – the Economic Development Ministry goes so far as to say “favorable” – despite the war in Ukraine, mobilization and a mass exodus from Russia.

But the flip side is an unprecedented labor shortage. In the last three months of 2022, there were 2.5 vacancies for every unemployed person in Russia, the highest ratio since 2005, according to calculations by analysts at the FinExpertiza auditing and consultancy network. That trend has continued into this year.

The labor market follows a seasonal pattern with demand for staff increasing in the spring toward a summer peak. Sanctions and the departure of many foreign companies from Russia did not lead to an immediate rise in unemployment. Instead, firms switched staff to part-time and curtailed recruitment programs.

Every second business faced staff shortages last year, according to Central Bank calculations. Half that group was already experiencing difficulties before the war, while a quarter said that the problem was directly connected with a shortage of suitable candidates. The ratio of vacancies per jobseeker increased over the course of 2022 from 2.1 in the first quarter to 2.5 in the last quarter. The biggest staff shortages affected male-dominated industries such as mechanical engineering, metallurgy, construction and transport.

Too few men

According to conservative estimates, two waves of wartime emigration and September’s mobilization cost the workforce about 600,000 men — 2% of all men aged 20-49 (in total there are 30 million men of this age in Russia, according to economist Vladimir Gimpelson, who specializes in the labor market).

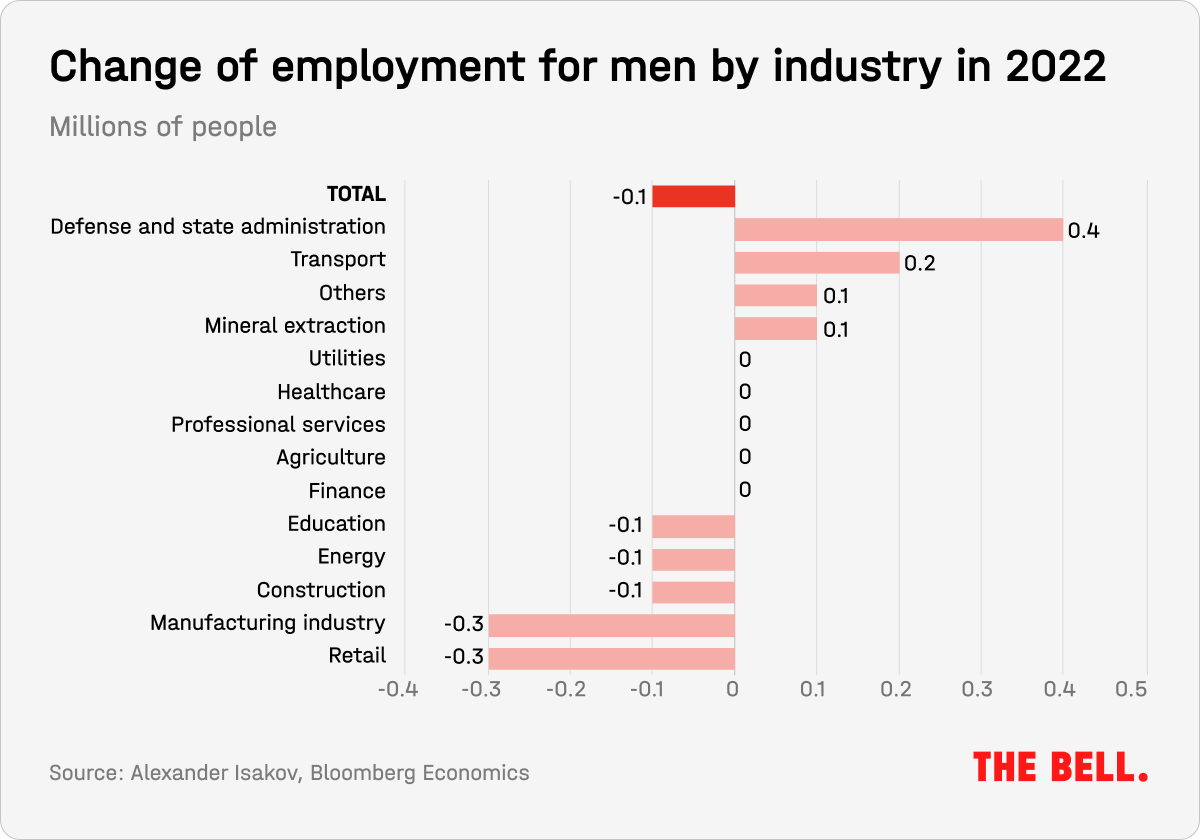

At the same time, 390,000 men moved to posts in military, security and public administration roles, according to calculations by Alexander Isakov of Bloomberg Economics. They have largely moved from construction, processing and retail, Isakov suggested. There have been less obvious changes in employment patterns for women.

A lack of male candidates has forced some companies to hire women in traditionally male roles, such as drivers. In Siberia, some firms are offering temporary contracts to minors aged 16-18 and elderly candidates, the Central Bank reported. A growing number of businesses in some regions are asking staff to recommend new employees, while five factories in Altai region have installed robotic welding systems to compensate for a lack of staff.

There are several reasons for the shortages:

- Defense industry businesses are taking on workers from the civilian sector. This is a problem because the transition typically restricts the potential of the overall economy.

- Two waves of emigration led to the departure of many qualified specialists, while foreign companies left Russia and local operations mothballed plans for expansion due to increased uncertainty.

- Many people (almost 40 million) are working in the small business sector, or as individual entrepreneurs, self-employed or in casual employment. Moreover, according to the Federal Tax Service, the number of self-employed individuals went up 1.7 times to 6.5 million last year. By the end of January, that figure had risen to 6.78 million. As a rule, when workers are laid off or dismissed, they drift into this segment. There is far less movement in the opposite direction.

- It is impossible to replace specialist staff who left Russia after the outbreak of war.

Migrants trends

As many as 3.47 million foreigners came to Russia for work last year. That’s about a 30% year on-year increase, FinExpertiza calculated using data from the Federal Security Service (FSB) and the Interior Ministry. In 2019, the last year before the pandemic, 4.1 million foreigners — mostly from Central Asia — came to work in Russia (12.5% of the labor market). Migrants were primarily attracted by the strong ruble: at the start of the war, when the ruble tumbled against the dollar and the euro, migrants left. According to NGO Memorial, by the start of April last year 60,000 people had returned to Central Asia’s Tajikistan and 133,000 to Uzbekistan. However, this trend quickly reversed as the ruble recovered.

Migrants continue to come to Russia for work despite facing a greater risk of being caught up in the war. In particular, Memorial established that, after Russia invaded Ukraine, Defense Ministry officials threatened to revoke the passports of new Russian citizens from Central Asia if they refused to serve in the military. As well as that stick, the authorities dangled the carrot of an accelerated pathway to citizenship and higher salaries.

“In migrant chats, joining the military or working in the occupied territories is actively promoted, everybody knows about these opportunities. They offer Moscow salaries,” said Temur Umarov, a Central Asia specialist at the Carnegie Endowment for Peace. “But in the end it turns out that they do not pay enough, they house people in barracks or, at best, in school or sanitorium buildings. Migrants find themselves in the line of fire.”

Climbing salaries

Employers continue to compete for staff by raising salaries. This trend can be seen in almost every region, according to the Central Bank. Between January and December, real salaries dropped 1% compared with the equivalent period of the previous year. However, in December salaries went up 39% compared with November (that increase is partly due to end-of-year bonuses). In the fourth quarter, real salaries were up 0.5% year-on-year.

Labor shortages drive inflation. This is because pay rises are the mechanism that most companies intend to use to keep and attract workers: 82% of businesses raised staff pay in 2022 and a further 73% plan to do so in 2023, according to a Central Bank survey. In other words, we will likely see significant pay rises this year.

This does not correlate with increased productivity. According to the Organization for Economic Cooperation and Development (OECD), over the decade from 2011 to 2021, labor productivity in Russia fell 1% per year (calculated as the ratio of GDP to total labor force).

Why the world should care

Any attempt to switch Russia’s economy to a “war footing” to boost output or promote import substitution will inevitably lead to a labor shortfall. Defense industry businesses can switch to operating 24 hours, but there will be nobody to physically do the work. Within the labor market, it’s unlikely that we will see a shift of couriers, drivers and the self-employed into factory jobs, according to labor market expert Gimpelson.

Russia is now the biggest foreign investor in Iran

The last financial year saw Russia invest $2.76 billion into the Iranian economy, Iranian Finance Minister Ehsan Khandozi told the Financial Times this week. That means Russia is now the Middle Eastern country’s biggest foreign investor.

- Russian money accounts for two thirds of all direct foreign investment into the sanctioned Iranian economy (last year’s total was $4.3 billion and it was $1.45 billion in 2021). Khandozi named China as his country’s second largest economic partner, but they invested just $131 million in 14 projects last year.

- Khandozi did not mention any specific Russian-Iranian projects, but he spoke of strategic cooperation with Russia and mentioned improvements to the countries’ interbank transfer system.

- He described the conflict in Ukraine as “unfortunate” for his country, although Iran’s only visible involvement to date appears to be the supply of kamikaze drones to Moscow. Officially, neither side recognizes that such sales are taking place.

- Until last year, 80% of Russian-Iranian trade involved food and agriculture products. And Iran increased industrial exports to Russia by 30% (products include polystyrene, pumps, auto components, machine tools for metalworking etc) in 2022. That volume is greater than Iran’s imports of manufactured goods from Russia, RBC reported with reference to a report by Iran’s Chamber of Commerce and Industry. The Chamber has also urged greater cooperation to develop the so-called North-South transport corridor. Last week, during his meeting with business leaders, President Vladimir Putin also talked about this issue.

Why the world should care

The invasion of Ukraine and Russia’s break with the West is pushing the Kremlin closer to Iran. It is an open question how much deeper this cooperation can go.

What Russians think about the war

Russians have a contradictory attitude to the war in Ukraine, but would not easily accept the possibility of defeat, according to researchers at the Public Sociology Laboratory.

In the spring of last year, the Public Sociology Laboratory conducted more than 200 in-depth interviews with supporters and opponents of the war. Between October and December 2022, they did a further 88 interviews (including some repeats).

They came to the following conclusions:

- People in Russia have a “piecemeal” attitude toward the war, characterized by contradictions and built on narratives from both sides.

- Unhappiness about mobilization does not translate into unhappiness about the war. For Russians far removed from politics, mobilization and the war are distinct events.

- Any talk of the need to end the war as quickly as possible means only victory. It is impossible to countenance defeat, even in a war started without good reason.

Figures of the week

Russia’s Economic Development Ministry reviewed its prognosis for growth in Russia’s economy: instead of a slump (-0.8%), it now anticipates growth of 0.2%.

Weekly inflation in Russia for the week to March 20 accelerated to 0.1%. However, annual inflation slowed from 7% to 6%. Fruit and vegetables even reduced in price over the week (by 0.4%) although prices increased for many basic products. Airline ticket prices rose 6.6%.

Public inflationary expectations for the year were down 1.5 percentage points in March, but remain elevated.

The Central Bank resumed publication of the structure of its international reserves. Now, the only data missing from its website is from April to December last year. On March 1, the Central Bank held reserves of $574.2 billion (compared with $617.1 billion a year earlier). Foreign currency made up $410.6 billion of this, with $135.5 billion in gold.

What to watch in the coming week

- A large statistics release from from the State Statistics Service (March 29)

- Industrial output for Jan-Feb 2023

- Inflation for the week of March 21-27

- A report into the socio-economic situation in Jan-Feb

- The Central Bank may publish its annual report (March 29)

- Balance of payment data for Q4 2022 (March 29)

Further reading

- ‘Productive forgetting’ Historian Todd Shepard reflects on Russia’s war against Ukraine through the prism of the Algerian War and France’s decolonization

- ‘Once we’ve started we can’t stop’: Svetlana Erpyleva examines how Russian attitudes to the war in Ukraine are changing

- ‘Satellites of stagnation’ Pavel Luzin discusses Russia’s military space programme during wartime‘How Kiriyenko Is Winning Putin’s Ear’ Andrei Pertsev argues that top Kremlin official Sergei Kiriyenko is doing everything possible to make himself irreplaceable

The author of this newsletter is one of Russia’s leading writers on this topic: independent economic analyst Alexandra Prokopenko. Alexandra worked as an advisor at Russia’s Central Bank and Moscow’s Higher School of Economics from 2017 to 2022 — and before that she was an economic journalist for Vedomosti, then Russia’s leading business newspaper. Today, Alexandra is a columnist at the Carnegie Endowment for International Peace and a visiting fellow a the Center for Order and Governance in Eastern Europe, Russia, and Central Asia at the German Council on Foreign Relations. She holds an MA in Sociology from the University of Manchester.