Russia is sacrificing the ruble to be ready for new sanctions

1. Russia is sacrificing the ruble to be ready for new sanctions

Photo crerdit: TASS/Alexey Pavlishak

What happened

“We continue to hear more information from the Russian government than from our own,” – that’s how U.S. Senator Bob Menendez, one of the authors of a new anti-Russia sanctions bill, attacked the Trump administration on Wednesday. There was no bad news from the U.S. (sanctions have been causing upheaval in the Russian market all through this year). But Russia’s own actions were enough for the ruble to lose 3 percent this week, falling yet again.

- This week’s events have made it perfectly clear that the Russian authorities are serious about getting ready a new round of sanctions. There are no fantasies of ditching the dollar: the Russian government is storing up reserves that the U.S. will be unable to freeze. The Central Bank, which has already sold most of its U.S. Treasury holdings (worth about $85 billion), is now investing money in record-breaking purchases of gold. And the Ministry of Finance is purchasing foreign currency — even while its buying spree threatens the stability of the ruble.

- The Ministry of Finance is buying foreign currency to replenish its sovereign reserve fund, where the profits from energy exports accumulate. All budget revenue gained from oil exports when the price is above $40 a barrel is automatically sent to the fund. After several years of recession and low oil prices, the fund was almost empty at the start of 2018, and plans were announced to replenish it to the tune of about 2.7 trillion rubles ($47 billion at that time).

- It was clear the Ministry of Finance’s plan to purchase up to $200 million a day on the currency markets would put pressure on the ruble. However, high oil prices and the beginning of an economic revival were an initial counterbalance. Back then, it was unclear how the ruble would be impacted by sanctions. Over the first 8 months of 2018, the Russian currency has dropped almost 20% against the dollar. At the most difficult moments for the ruble, foreign currency purchase were discontinued. The last time this happened was during the crash of the Turkish lira on 9 August. But this week the Finance Ministry has drawn severe criticism from analysts for renewing currency purchases ahead of the new U.S. sanctions coming into force and against the backdrop of an unsettled situation on emerging markets. As a result, the ruble lost another 3% in two days and purchases were paused again anyway. At the moment, the Russian currency is trading at its lowest level since March 2016, though back then a barrel of oil cost $35 whereas now it is $74.

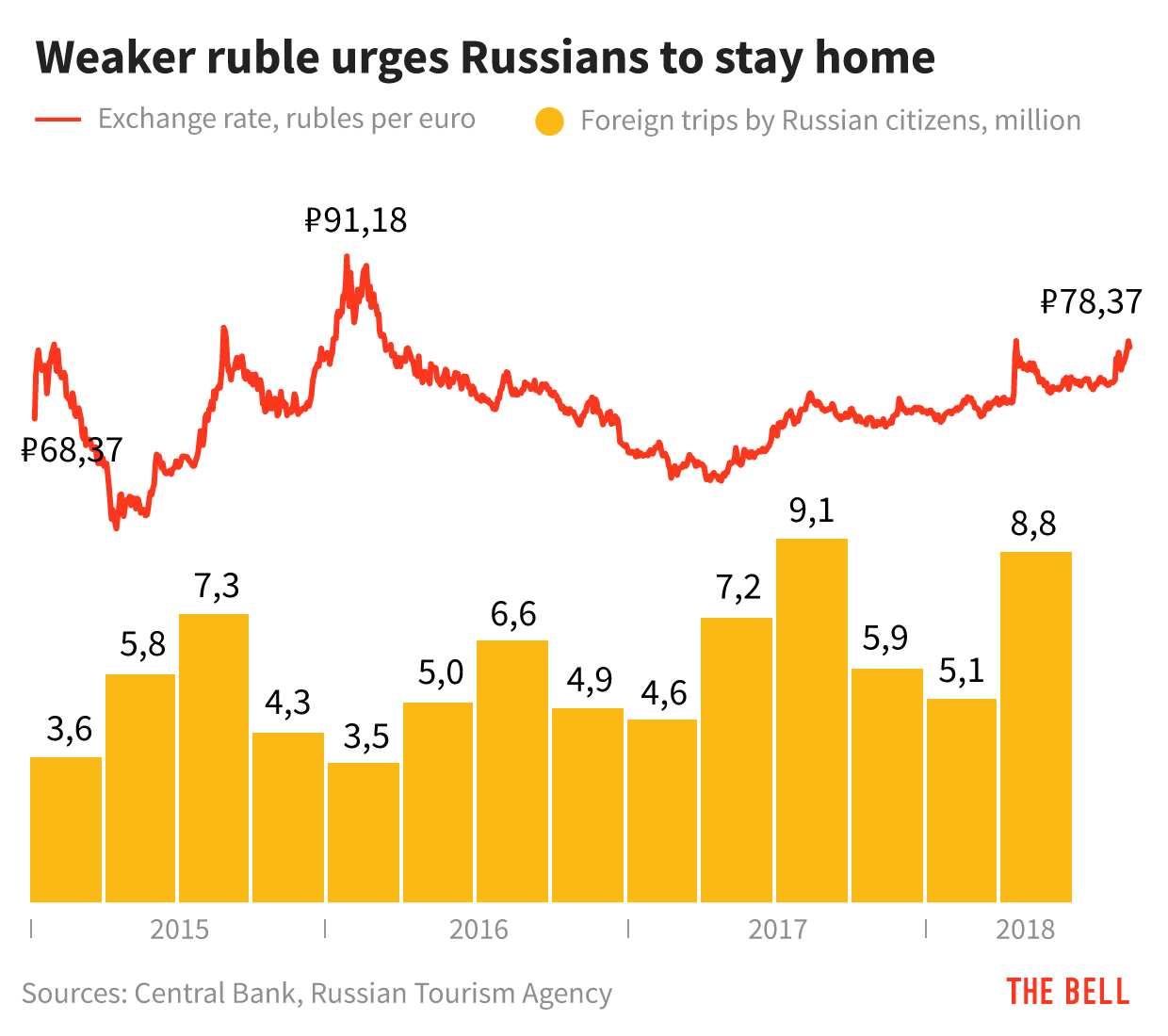

- In many ways, a cheap ruble is profitable. For raw materials exporters (that is, for most large Russian companies), which spend in rubles and earn in foreign currency, falls in the national currency equate to a profit windfall. The same is true for the government: the cheaper the ruble, the cheaper it is to spend. Inflation remains at a record low (0.3% in July 2018), which means that the declining ruble will not affect the majority of Russians. As is always the case, the main victim is the middle class, which buys foreign goods and goes abroad — but there weill be fewer and fewer such people in Russia.

Why the world should care

During hearings in the U.S. senate about Russia on Tuesday, senators complained that anti-Russia sanctions do not work. The new sanctions, they suggested, should be tougher. However, by now the Russian government is using this threat to its benefit, while it is getting ready to take the blow.

2. Russia’s leading opposition figure is waging war on the media

What happened

The talk of the month in Russia’s media community is a conflict between the most popular opposition politician, Alexei Navalny, and reputable business daily Vedomosti — one of the few relatively independent Russian media outlets (and a former partner of The Financial Times and The Wall Street Journal).

- The conflict was triggered by Navalny’s expose that the 82-year-old mother of State Duma speaker Vyacheslav Volodin, who was a school teacher all her life, owns an apartment worth $3.4 million. Vedomosti refrained from publishing the news of the accusations, instead requesting documents from the registration authorities and comments from Volodin and Navalny. Other private Russian publications took different sides. Some, like news website RBC, just skipped the story. Some, like Riga-based Meduza, published it without any of its own proof. While the BBC Russian Service found corroborating evidence a day earlier than Vedomosti.

- But Navalny’s primary target was Vedomosti. He accused the newspaper, which has been one of the most diligent in following his anti-corruption campaigns, of censorship at the Kremlin’s behest. He alleged that Vedomosti’s owner, Demyan Kudryavtsev, took part in the 2018 presidential election campaign of Ksenia Sobchak, who was supported by the Kremlin to counter Navalny. Vedomosti journalists replied that they were following editorial standards, which require documentary evidence as well as comments from the accused party. Technically, this wasn’t a dishonest answer and Navalny’s accusations were clearly exaggerated. However, Kudryavtsev’s involvement in Sobchak’s campaign is well known and even Kudryavtsev has himself admitted it. This is a clear conflict of interest, which the paper has never admitted. Vedomosti never put disclaimers in its many pieces about Navalny and Sobchak.

- A conflict between Navalny and the press was inevitable. In many ways, Navalny’s relationship with the press resembles that of Donald Trump’s. He owes much of his fame to the press: when he started out he was busy unearthing corruption in state-owned companies and Vedomosti, as a business daily, paid more attention to this struggle than most media outlets. But, after 2010, newspaper readers have increasingly switched to social networks where Navalny is better informed than most journalists. This August, the monthly audience of Navalny’s website and YouTube channel (without taking into account his other social media) reached 14 million people — more than Vedomosti’s audience. At the same time, Navalny works with databases and has recruited a professional team that makes his blog nothing less than the best investigative outfit in the country. On the one hand, this outfit does the work of journalists (and does it very well), but, on the other hand, it is a political undertaking, which has no obligation to abide by standards of fairness and neutrality. The nature of the relationship between such an entity and journalists bound by professional ethics means that there are many potential conflict. It is surprising the first large-scale row has only just taken place.

Why the world should care

Independent Russian news outlets are scarce and it’s important to understand their approach to information. In Navalny’s conflict with Vedomosti, both sides are guilty of some hypocrisy. For Navalny, the story is just about censorship — but it is clearly also about media influence and his personal conflict with Sobchak. Vedomosti cites editorial standards, but it is no secret that in such a situation those standards wouldn’t usually be observed so strictly. Bottom line: even independent sources of news about Russia have their own bias and must be viewed critically.

3. The change of owner at a $4 billion Moscow real estate company is a headache for its Eurobond holders

What happened

This week, Russia lost one big, private business. An outfit connected with state-owned oil giant Rosneft, gained control of O1 Properties, whose Moscow real estate portfolio is valued at $4 billion. The former owner of O1, Boris Mints, moved to London earlier this year under the threat of a criminal trial. Now the holders of O1’s Eurobonds, valued at $350 million, can claim their money — but the company says it will not be able to make the payments.

- O1 Properties is one of the largest real estate companies in Moscow. Its portfolio includes 743,000 square meters of the most expensive offices in Russia’s capital. By the end of 2017, the value of its properties was $4.23 billion, while the company itself was worth $867 million. On 21 August, O1 Properties announced a change in its controlling shareholder. A Cyprus company, Riverstretch Trading & Investments (RT&I), became the new owner. According to media data, this company serves the interests of Rosneft.

- Mints was forced to go to London in the spring after the Investigative Committee became interested in his business. O1 Properties’ projects were financed by Otkritie Bank, which collapsed and was nationalized last year. Mints was one of the bank’s founders. After the nationalization of Otkritie Bank its new management team sued O1, accusing Mints of asset stripping to the tune of 30 billion rubles ($500 million).

- RT&I got O1 Properties in exchange for debt. 62.5% of the company’s shares were held by Credit Bank of Moscow, which was closely connected to Otkritie Bank. But after a 2017 “purging” of Russian banks, it found itself under the influence of Rosneft.

Why the world should care

O1 Properties has a Eurobond issue worth $350 million with a coupon of 8.25% placed on the Irish Stock Exchange. If the company’s owner changes, the prospectus gives bondholders the right to submit for a repayment at 101% of face value. To date, the bonds are traded at 65.04% and earning per bond is 25.24%. The new O1 owners started negotiating with large bondholders as early as June. But on 21 August, after the official change of the owner took place, bondholders were reportedly asked not to submit bonds for repayment because the company hasn’t enough money. However, if the company can succeed in convincing major holders not to submit the notes, it might pay out lesser holders.

Peter Mironenko