Russia targets offshore tax dodges

Officials in Moscow this week began withdrawing from a long-standing double taxation treaty with Cyprus. The process means that the Mediterranean island looks set to be the first of several popular offshore tax havens to be targeted by Moscow: Malta, Luxembourg and the Netherlands are next on the list, with other nations likely to follow.

What’s happening?

We first heard the idea of tackling offshore tax avoidance back in March during President Vladimir Putin’s first public speech about the coronavirus situation. He proposed a 15 percent tax rate on dividends and interest payments made from Russia to companies in offshore zones (at present, the rate is zero, or next to nothing). If payments were not forthcoming, the proposed next step was to scrap existing double taxation treaties.

After Putin’s speech, Russia’s Ministry of Finance began negotiations with Cyprus. This week, officials admitted they had reached an impasse, and Russia began exiting its existing tax agreement. Next on the ministry’s hitlist are Malta, Luxembourg and the Netherlands.

Why does it matter?

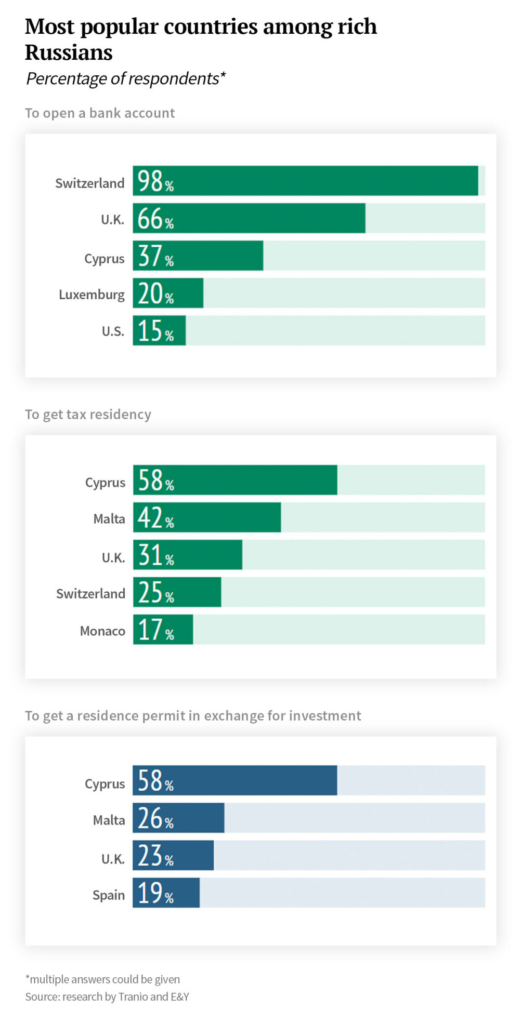

Cyprus is renowned as one of the most popular foreign destinations for Russian money. According to the Ministry of Finance, more than $19 billion was sent there in 2018, and, the following year, the figure was $25.9 billion. In total, that’s more than has been allocated by Russian officials to support individuals and businesses during the pandemic.

- Tearing up these agreements will make life very difficult for wealthy Russian investors and large companies alike. There are many Russian companies that structure their businesses so they pay dividends or interest offshore and reduce their tax bills.

- A simple example: a business trades in Russia but is legally registered in Cyprus. When it is time to pay dividends, the money goes to the Cypriot company and is taxed at about 5 percent. If the same dividends were paid in Russia, they would be taxed at 15 percent.

- This all means that, when the double taxation agreement ends, dividends will be taxed higher and twice – in Russia and in Cyprus. Individuals will also be liable for two tax bills.

- The head company of Tinkoff Bank, Russia’s 16th largest bank, and the largest shareholder of NLMK, the world’s biggest steel company, are among the Russian businesses registered in Cyprus. In recent years, they have been joined by Russian IT start-ups.

- Yandex – the so-called ‘Russian Google’ – and X5 Retail Group, the country’s largest retailer, are both registered in the Netherlands.

Context

Russia is not the only country trying to curb murky tax avoidance schemes. It’s not a simple process, however, and legislators must identify and target businesses that go offshore to avoid taxation without harming organizations that have a legitimate reason to operate offshore.

In the last two years, Cyprus itself has sought to cut the number of Russian investors amid concerns about suspicious money flows incurring U.S. sanctions. The Cypriot authorities tightened up financial accounting rules and revoked citizenships granted through its ‘golden passport’ investment scheme. Baltic States – especially Latvia – are taking similar measures.

Why the world should care

Labyrinthine tax avoidance schemes involving Russian firms still use Cyprus and other offshore destinations, according to tax lawyers. But this is getting ever more difficult. In some cases, companies might have to re-register, while individuals are likely to start looking further afield, including to Singapore or Hong Kong. Will these tectonic shifts mean we start to see Russian funds flowing back home, or flooding into other offshore zones?

Anastasia Stognei