Russian online giants plot U.S. IPOs

Russian online giants plot U.S. IPOs

This unpredictable year could be set to end with something of a sensation for the Russian business world — not one, but two major Russian firms are planning U.S. IPOs in the coming months. After a series of juicy IPOs in the early 2010s, stock market launches have become something of a rarity for Russian companies in recent years, but the two tech giants — established online retailer Ozon and leading Russian streaming service ivi — are poised to make a big splash.

- The planned IPOs were initially reported by Reuters and the Wall Street Journal, both citing unnamed banking sources. At the moment, we know more about Ozon’s planned listing, which the company subsequently confirmed. Russia’s first large online retailer is lining up a stock market float for either later this year or early 2021. Documents have already been filed with the U.S. Securities and Exchange Commission (SEC), and Ozon has enlisted Goldman Sachs and Morgan Stanley as global coordinators for the listing.

- Ozon is expected to be valued between $3-5 billion. The last Russian company to launch in the U.S. was job search service HeadHunter, which secured a $650 million valuation in 2019.

- Ozon’s shareholders include Baring Vostok, whose founder Michael Calvey has been under arrest for more than a year, and Vladimir Yevtushenkov, founder of Sistema and ranked 65th on the Forbes list of richest Russians.

- The company has been looking at different ways to raise development capital for a while. Back in July 2019, The Bell reported (Rus) that Sberbank was interested in acquiring a large stake in the retailer. This summer, Reuters said (Rus) the bank was close to buying a 30 percent share of Ozon, at the same moment when Sber was winding down its plans to create a ‘Russian Amazon’ with Yandex.

- Less is known about ivi, with fewer details of the IPO having emerged and fewer indications as to the company’s plans. But this is clearly a good time to move. Throughout the pandemic, both online retail and online cinema have been on the up. Russia is Europe’s biggest market for internet users, with approximately 100 million people online and the e-commerce market grew by 23 percent last year to $31 billion, analytical agency Data Insight reported. That’s comparable with India (population: 1.3 billion) and only slightly less than Canada, according to WSJ.

Why the world should care Any IPO is an event in itself, but this one confirms that Ozon is not about to merge with either of its biggest potential rivals — Sberbank or Yandex. Instead, by opting for a stock market launch, Ozon is ensuring that — for the foreseeable future — the competition for a share of Russia’s booming online market is going to be more than just a straight fight between those two.

Ruble falls firmly out of favor

Russia’s currency is not known for its stability. But at the end of last year the ruble was being touted as a darling of both investors and financial journalists. Bloomberg described it as “a trade-war refuge” while global investors called it a “ray of light” among emerging market currencies. Fast forward to October 2020, and this fleeting uptick in the ruble’s reputation has completely faded, replaced by the more familiar state of uncertainty — arguably to an even greater extent than before.

- Russia’s currency has fallen heavily against the dollar and the euro. Since the start of the year the ruble is down by 30 percent and 36 percent respectively. Against the euro, it has dropped to rates last seen in 2016, and is closing in on the absolute record lows printed in 2014 (then the euro was worth 100 rubles, while this week it hovered around 93). Against the dollar, the currency bottomed-out at 79.9 rubles this week — far away from the 61-62 rubles a dollar was worth back in January.

- Even Putin’s press secretary, Dmitry Peskov, felt obliged to comment on the state of the currency. The recent past, he noted, does indeed show episodes when the ruble loses its value. But these are followed by periods of recovery. He said he had no doubt this cycle will repeat itself once again, but added: “the timeframe for this is a different question.”

- Analysts see only bad news on the immediate horizon for Russia’s currency — and those who get paid in it. They don’t anticipate any strengthening of the ruble in the foreseeable future and identified several reasons why the fall could continue. Chris Weafer, senior partner at Macro Advisory and former chief strategist at Troika Dialog and Sberbank CIB, branded the ruble “the currency of fear,” stating: “I doubt that any measure of good news would pull the ruble back over the short term as the accumulation of negative factors is simply too overwhelming.”

- What’s hurting the ruble? For starters, the general background: a second wave of the coronavirus, the subsequent economic slowdown and the resulting fall in oil prices. It’s true that the ruble is much less susceptible to swings in energy prices now than before. Thanks to the balancing effect of the Central Bank automatically buying or selling rubles depending on the oil price (the so-called ‘fiscal rule’), the market seems comfortable with oil around $42 per barrel. At the same time, geopolitical factors are exerting a far greater impact on the currency than before.

- And suddenly the stars on that front are in malignant alignment: the poisoning of Alexei Navalny, the ongoing political crisis in Belarus, the simmering conflict in Nagorno Karabakh and, most importantly, the U.S. presidential election. The outcome of next month’s ballot directly affects the ruble’s prospects. Under Donald Trump, we can expect a continued policy of soft sanctions, as we’ve seen up until now, and thus a limited threat to the ruble. However, Joe Biden promises genuinely tough sanctions, combined with a block on foreign investors purchasing Russian state debt. Precisely because of the huge uncertainty over the election results, the ruble is currently highly sensitive to any external shock, analysts conclude.

- That hypothesis seemed to be proved Friday morning by the reaction of the Russian market to the news that Trump had tested positive for the coronavirus. After he confirmed the infection in a tweet overnight, the Moscow Exchange opened 2% down and the ruble fell back yet again against the dollar and euro. Even more so: a slump in the currency in recent months has mirrored rising betting odds of Biden beating Trump on Nov. 3, as Bloomberg discovered.

Why the world should care Over the long term, a strong currency is profitable — not least because it enables a country to attract long-term investment (although in Russia’ case this is already limited for various other, mainly political, reasons). At the moment, a weak ruble isn’t necessarily a bad thing for the Russian economy, since it is based on exports. But the key point remains: any economy needs a stable currency in order to effectively budget and know what it can spend. The more volatile the ruble, the harder it is for Russia to plan. The other important factor is that unlike many other negative trends, a falling ruble has an immediate effect on Russian society, and could well become a source of discontent.

A second wave of the coronavirus: New restrictions, same unreliable statistics

In our last newsletter we highlighted COVID-19’s return to the Russian news agenda. This week saw the introduction of new restrictions designed to control the spread of the virus — although neither the government nor businesses want a repeat of the strict lockdown Russia imposed in the spring, sources told The Bell.

- As in the first wave, Moscow has seen the biggest rise in new COVID-19 infections, as well as the strictest new controls. Mayor Sergei Sobyanin unexpectedly closed schools for two weeks, ordered employers to ensure at least 30 percent of their staff are working remotely and told over-65s to stay home. But compared with the total lockdown imposed earlier this year, when shops and cafes were closed and people needed permits to leave their homes, the new measures are still soft.

- Nobody is currently contemplating more radical measures for Moscow, according to The Bell’s sources at City Hall. That fits with the information (Rus) reported by Open Media’s sources in the federal government, which is also keen to avoid a strict lockdown. Business figures told The Bell that they have heard nothing about further coronavirus restrictions so far.

- At the moment the main measures seem to be verbal instructions. There’s a mixture of exhortation — such as Putin urging (Rus) Russians to remain vigilant in order to prevent a return to a spring-style lockdown — and threats — Sobyanin, for instance, warned Moscow residents: “if we don’t take this seriously, then the probability that we will have to take tougher measures is very high.”

- The situation with the virus is clearly growing worse every day. In September, the infection rate was 10 percent higher than in August. But daily case numbers have still not reached the previous peak — seen on May 11, when Russia reported more than 11,600 new infections. Russia confirmed 9,400 new infections Friday. In Moscow, a new peak is even more distant. The capital recorded 2,700 new cases Friday, compared to its record high of almost 7,000 on May 9.

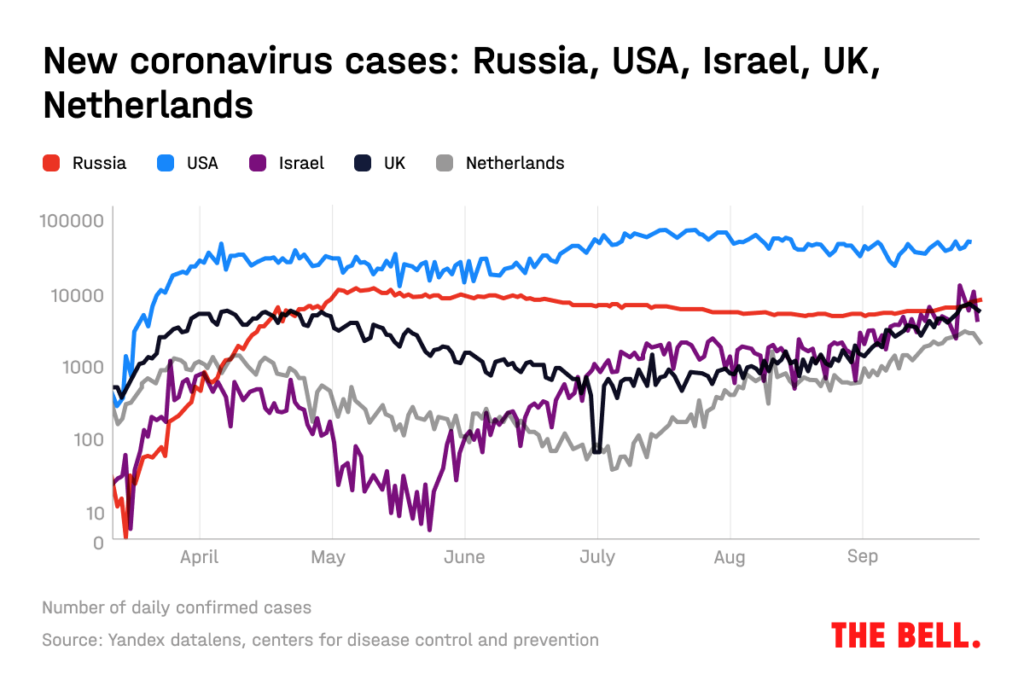

- However, obtaining the real picture of Russia’s battle with the coronavirus is not straightforward, given serious doubts over the reliability of the figures. It’s easy to understand the problem by looking at a graph of daily infection rates in Russia and other countries.

- The Russian curve is the only one that levelled out and flattened in June — at the time when sources were telling The Bell and Open Media that the authorities had decided to ease restrictions on Russians to give them some breathing space before the constitutional referendum. That flattened curve could be due to falsified data, and the fluctuations that appear from mid-September might be evidence that the numbers are starting to return to something closer to reality. Sources in City Hall told The Bell that there was a decision to relinquish control over the statistics so that people could see the true state of affairs.

Why the world should care The first wave of the coronavirus didn’t hit Russia too hard (although questions remain about the number of deaths, particularly among medics), especially when compared with neighboring Belarus, where Alexander Lukashenko simply ignored the pandemic — a decision that contributed to the protests. But there are big questions about whether Russia can repeat its springtime experience now, when an impoverished population and an angry business community will greet any new quarantine with hostility.