Russian ruble plummets amid Prigozhin rebellion

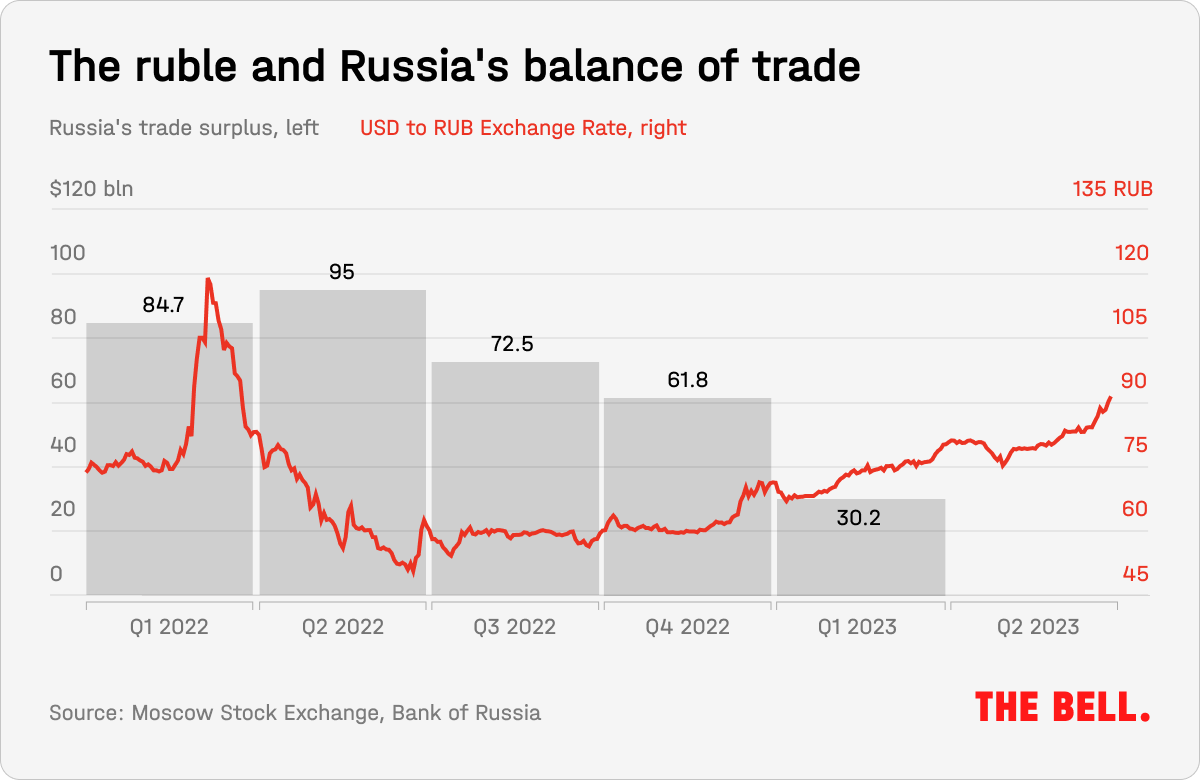

The Russian ruble has nose-dived in response to Yevgeny Prigozhin’s rebellion, accelerating its gradual depreciation since the end of last year. In the two weeks since June 24, the ruble fell 12% against the dollar and surpassed the symbolic 100 ruble per euro mark. The current exchange rates hark back to levels seen during the tumultuous early months of the war. The ruble's downturn was not unforeseen — throughout the preceding year, it was artificially inflated due to sanctions hampering imports while burgeoning oil prices boosted export revenues. However, reassuring the Russian people, who are used to assessing the state of the economy through the lens of exchange rates, remains challenging.

- In the two weeks from June 24 to July 7, the ruble experienced a dramatic fall. Against the dollar, it decreased from 84 to 91.2, and against the euro, it dropped from 91 to 100.3. At its nadir, one dollar cost 94 rubles and one euro was 102, the highest levels since March 2022, when the ruble was in freefall following the invasion of Ukraine. At that time, the government attempted to halt the slump using draconian currency controls.

- The ruble rebounded quickly in summer 2022 and reached a long-term high of 54 rubles to the dollar in November of that year. This resurgence had less to do with the state’s currency restrictions and more with the imbalance in Russian trade due to sanctions: rising oil prices inflated export values while trade embargoes dampened imports. In Q2 2022, Russia exported almost three times as much as it imported. However, as oil prices fell and Russian businesses discovered new ways to navigate trade restrictions, this imbalance began to level out, and the ruble started a steady devaluation — although nowhere near as rapid as in recent weeks.

- Prigozhin’s rebellion has triggered a new collapse for the ruble. Despite this, the fundamental factors remain the same: a shrinking trade surplus, capital outflow and an overall decline in the economic situation.

- As always, the ruble's fall will drive up prices for imported goods in Russia, particularly those not produced domestically, from smartphones and laptops to rum and whisky. Prices are likely to rise faster for goods arriving in Russia as “parallel imports” — a scheme introduced after Western sanctions that allows importers to bring in goods to Russia that were not originally intended for the country. We delve further into the implications of the ruble's collapse here.

Why the world should care

The ruble's depreciation exposes cracks in the Russian economy that President Vladimir Putin is keen to downplay. For Russians, this depreciation is an easy-to-understand indicator of economic health, as those who experienced the hyperinflation and currency crashes of the 1990s tend to closely monitor exchange rates and view them as an economic barometer.