Russia’s Journey Toward Economic Dependence on China

Chinese President Xi Jinping is set to visit Moscow next week. This is a traditional engagement: Russia is usually the first country any Chinese leader visits after his re-election. Moscow and Beijing describe their relationship as a strategic and comprehensive partnership and do all they can to emphasize a good friendship between their nations. However, after Russia’s invasion of Ukraine, the relationship has grown increasingly co-dependent.

Trade: second only to North Korea

According to Chinese customs data, trade with Russia increased by almost one-third in 2022, reaching a record $190 billion. Russia enjoys a surplus in these transactions: it imported $76.12 billion of goods from China, while exporting $114.15 billion.

The bulk of Russia’s exports to China were from the energy sector. Russia is China’s second-largest source of oil (up 8.2% to 86.24 billion tons a year) — only just behind the leading source, Saudi Arabia (87.48 million tons per year). Russia is fourth for LPG supplies, behind Australia, Qatar and Malaysia.

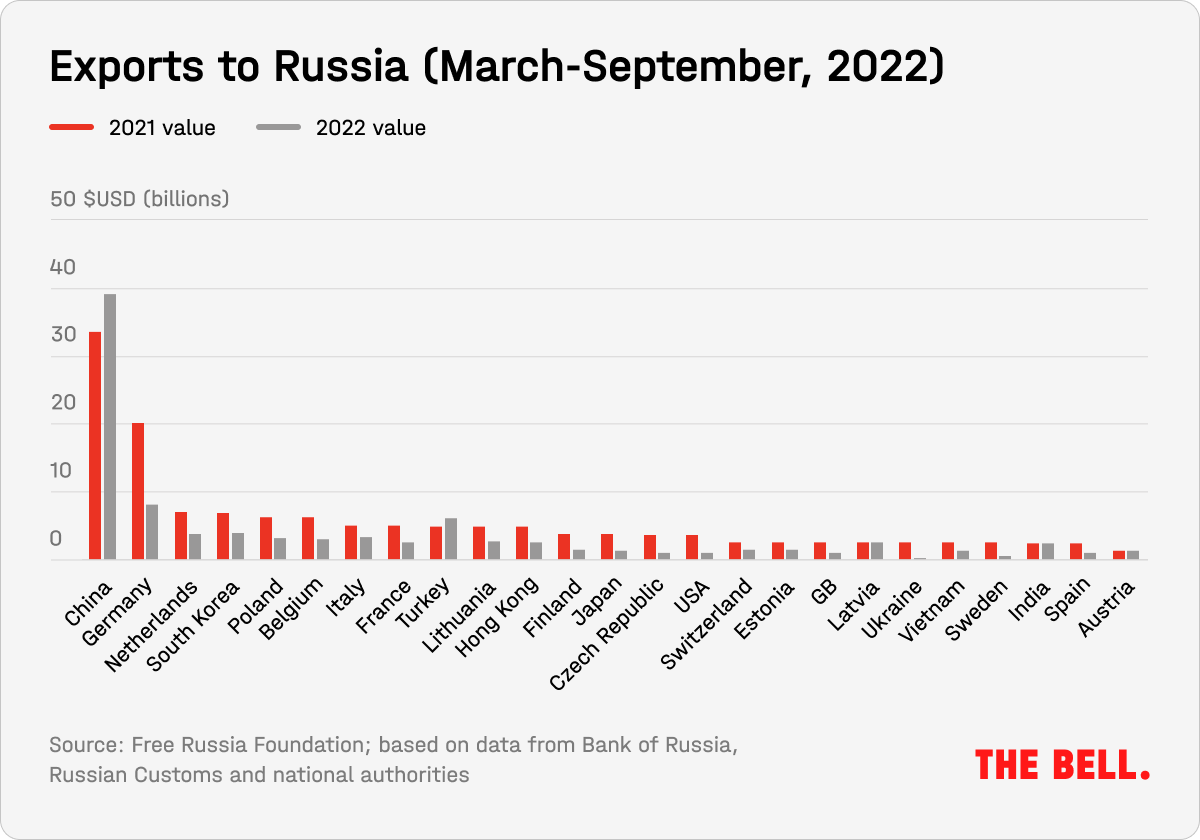

Since the invasion of Ukraine sparked sweeping sanctions on Moscow, China has become Russia’s main trading partner, and now accounts for more than 40% of commodity imports, according to the estimates of Iikka Korhonen, director of the Institute of Transition Economies at the Bank of Finland. In terms of import dependency on China, Korhonen said, “Russia is now second only to North Korea.”

Chinese firms are actively becoming involved in parallel import programs and trying to replace the Western brands that have left the Russian market. For example, of the 14 brands remaining on the Russian auto market, 11 are Chinese. At the same time, Russian dealers are actively securing supplies of familiar European brands via Asia. As a result, China became the biggest exporter of family cars to Russia.

In addition to leading in consumer goods, China delivers a large proportion of Russia’s technological imports. In 2022 there was a significant increase in deliveries of Chinese auto components as well as trucks, excavators and loaders. Imports of high-tech industrial equipment (classified in Russia as product group 84) went up 16% in 11 months of 2022, reaching $14.9 billion.

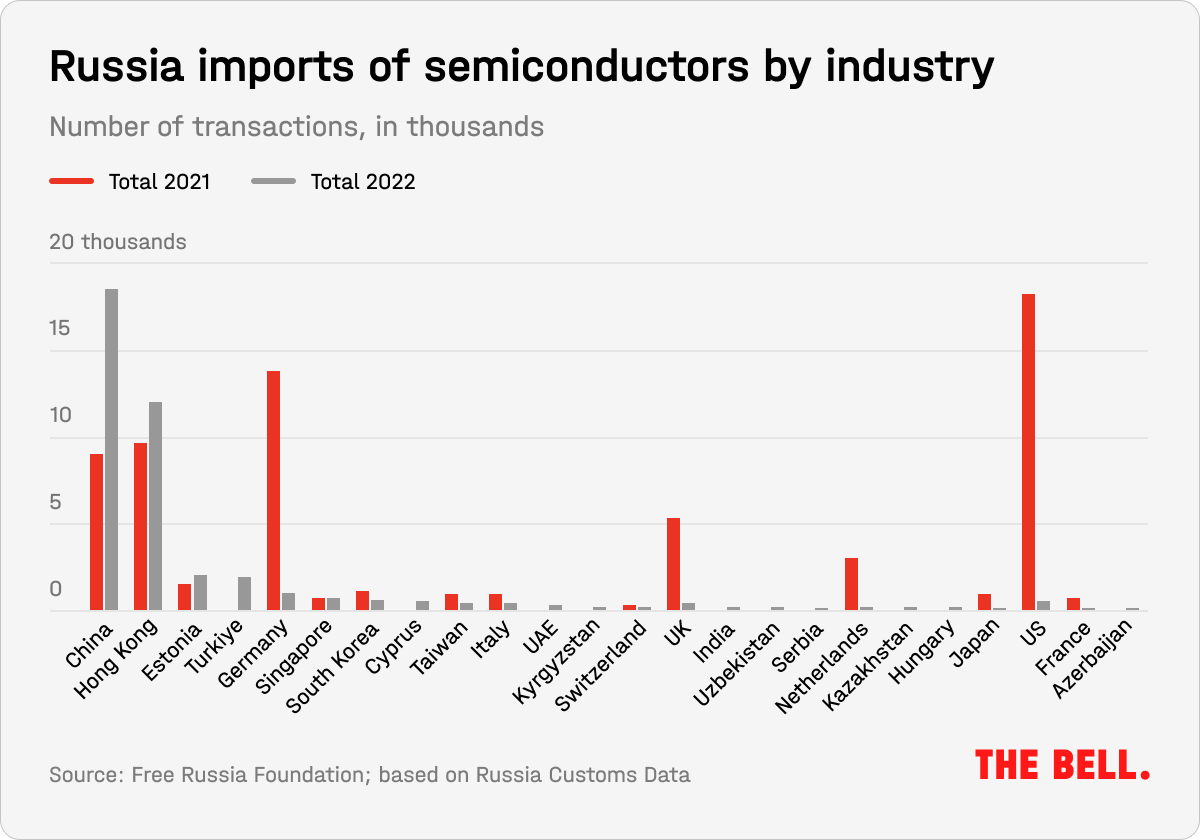

Despite all this, China continues to carefully follow Western sanctions when it comes to dealing with major companies. For example, the Chinese authorities banned deliveries of Loongson processors to Russia over concerns that they could be put to military use. However, firms in the second and third tiers which find it hard to break into the Chinese market are taking a close interest in the Russian microelectronics market, a source told The Bell. “Given the volume of production in China, it is easy to hide goods that are banned from export to Russia,” he said. Indeed, despite restrictions on supplies of semiconductors and microchips from the West, Russia still receives them in large numbers from China, according to a report from the Free Russia Foundation.

Currency: the yuan is replacing the dollar

There is a long-held belief that the yuan can never become a fully-fledged reserve currency due to China’s restrictions on capital transactions. However, the unprecedented Western sanctions on Russia have led to a serious internationalization of China’s currency. Back in 2014, the Russian authorities responded to sanctions by setting a course away from dependence on Western currencies in the finance sector, particularly the U.S. dollar. That process only accelerated after the Feb. 24 invasion.

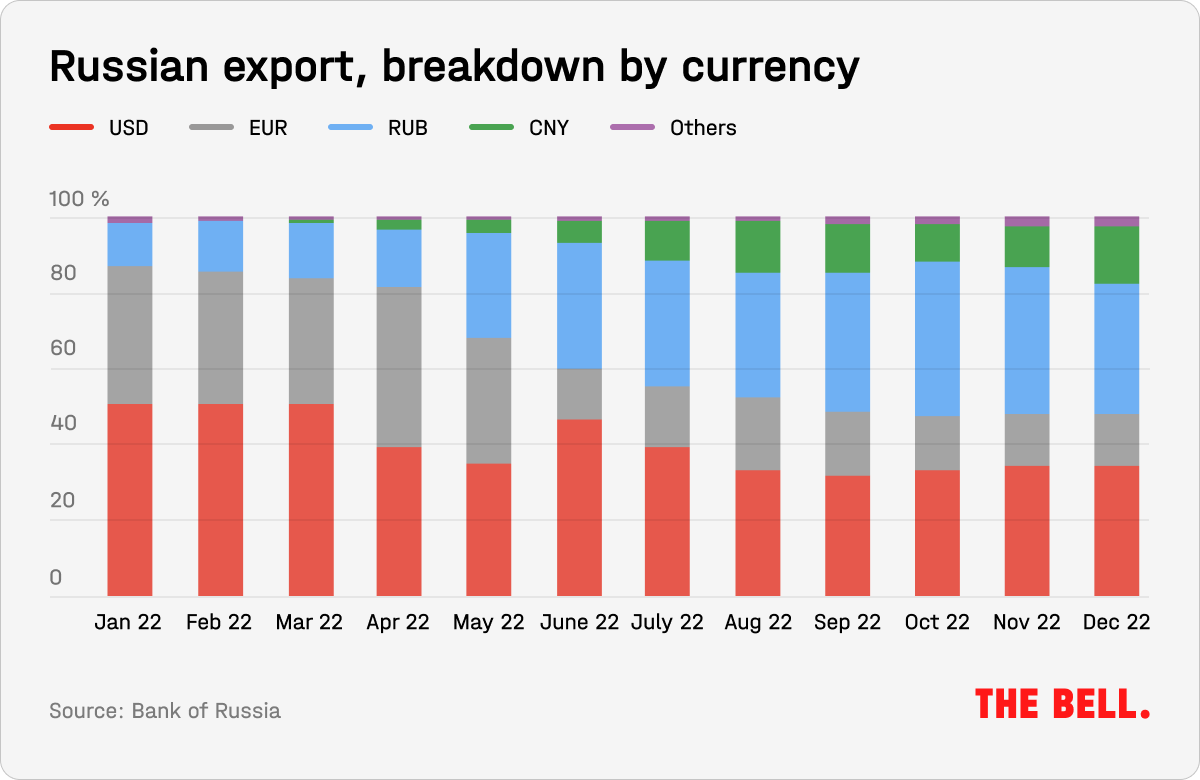

As a result, Russian firms now settle almost half of their international trades in rubles or yuan, Russia’s Central Bank calculated.

- In 2021, the yuan was used to pay for just 0.5% of Russia’s exports. By the start of 2023, that figure had risen to 16%. That enabled the Russian authorities to reduce the use of dollars or euros from 87% to 48%, with 34% of payments made in rubles.

- In payments for imports, the yuan’s share rose from 4% to 23%. At the same time, payments in dollars and euros fell from 65% to 46%.

Increasingly, Russian banks are offering their clients yuan instruments, companies are starting to issue bonds in the Chinese currency and the yuan is now the third most popular currency to hold forex assets among private savers in Russia. The Finance Ministry has substituted the yuan for the dollar in its forex interventions and the Moscow exchange is reporting a shortage of yuan.

The increased importance of the yuan in the Russian economy cannot be denied. The authorities are talking this up as a victory for “de-dollarization.” In reality, though, this merely switches from dependence on one foreign currency to another. This is an unreliable substitute: Russian reserves and payments are now become dependent on the exchange rate policies of the Communist Party and the People’s Bank of China which are not transparent to Russia's policymakers. If the relationship between Beijing and the Kremlin deteriorates, the risk of losing reserves or halting payments won’t go away.

Alexander Gabuev, a senior fellow at the Carnegie Endowment for International Peace, does not rule out the possibility of countries like Pakistan or the Central Asian republics following Russia’s example and moving away from the dollar as their dependence on China increases. “Other non-democratic countries like Saudi Arabia are watching Russia’s experience closely, and though they predominantly still rely on the dollar, they will cautiously increase the share of the yuan,” he told Bloomberg.

We’re still a very long way from any direct threat to the dollar, but a shift towards dividing the global economy into dollar and yuan blocs is significant. The Chinese authorities are quite resourceful when encouraging trade in the yuan: they can offer panda bonds, loans from Chinese development banks, a global clearing network and the CIPS payment system.

Beijing as peacekeeper

The two leading antagonists in the Middle East, Iran and Saudi Arabia, restored diplomatic relations in a deal brokered by China. Then, marking the anniversary of Russia’s invasion of Ukraine, Beijing published its 12-point Russo-Ukrainian settlement. That plan deals in broad strokes, is clearly unworkable and will have no impact on the course of the current conflict. However, it reminds other countries that they do not have to make a binary choice between Russia and the West, as Asia expert Mikhail Korostikov pointed out. Meanwhile, according to The Wall Street Journal, Beijing fears that Russia will be weakened by its war: Putin is a comfortable partner as he can be kept under control.

In 2022, China did not cancel a single joint engagement with Russia because of the war: no exercises, no joint bomber flights. This is how Beijing shows the wider world that it has no plans to join in the campaign to isolate Russia, Gabuev explained to The Bell. Moreover, Russia’s growing dependency on the Chinese market enables Beijing to dictate better terms in its contracts in, for example, oil and gas.

Why the world should care

Beijing is actively taking advantage of the opportunities generated by the war and the imposition of Western sanctions. Russia is an important source of inexpensive energy resources and critical military technology for China, Gabuev said. This also attracts the attention of the U.S. administration, so they have no time to watch on China. However, Russian hopes that China would help Moscow get around sanctions are not coming to fruition. Beijing continues to carefully comply with all prohibitions and restrictions on trade with Russia.

A visit from the leader of the world’s second-largest economy enables the Kremlin to boast that Russia is not isolated. The price of this “non-isolation,” though, is a growing political and economic dependence on China, which sometimes runs counter to Moscow’s own interests.

Putin at the Oligarch’s Congress

Vladimir Putin once again urged big business to invest in Russia. On Thursday, he visited the Congress of the Russian Union of Entrepreneurs and Industrialists (an association of big businesses), where he spoke at a plenary session and met with the Union’s board behind closed doors. His previous meeting with business leaders was on Feb. 24, 2022, the day Russia launched its full-scale invasion of Ukraine. Everyone in that meeting would later be targeted by Western sanctions.

There were no surprises in Putin’s public speech. Just as in his recent address to the Federation Council, Putin waxed ironic, mocking business’s old refrain that “there’s more stability in the West.” He touched on familiar themes, insisting once again that Europe “is punishing itself by cutting off relations with Russia” and “will still come to us to buy turnips.” He also hailed Russia’s economic achievements (we wrote more about the current state of Russia’s economy here).

The plenary session was stage-managed in the finest propaganda traditions. Following Putin, Sergei Kogogin, general director of the KAMAZ auto manufacturer, spoke of how sanctions represented an opportunity for import substitution. After that, the CEO of the Russian branch of Italian tool manufacturer Biesse spoke. Matteo Valica, an Italian with a Russian passport, said that many Western businessmen support Russia and asked Putin to allow these businesses to withdraw their dividends to the West (these funds are currently frozen in a special account). Next up, regional representatives of the RSPP spoke of staffing problems and a lack of investment in their regions. The words “war” or “special military operation” went unsaid. Putin was in a jovial mood.

Big business might not support the war (we wrote more about that here) but its leaders still turned out for the congress. During the broadcast, we could see Viktor Vekselberg (Renova), Alexei Mordashov (Severstal), Vladimir Potanin (Norilsk Nickel), Mikhail Gutseriev (Russnofts), Oleg Deripaska (RUSAL and GAZ Group), and Alexander Pumpyansky (Sinara). Among those present was Alfa Group co-founder German Khan, whose bid to have his sanctions lifted was supported by Leonid Volkov and other representatives of the Russian opposition.

No one in attendance was willing to openly object to Putin’s policies, nor to express any unhappiness about the current state of affairs: this has not been acceptable for a long time. In 2022, the president and his inner circle offered business a simple slogan: “If you’re not with us, you’re against us.” Anyone with something to lose makes the pragmatic decision to toe the line (you can read more about that here). Breaking ties with the state turns out to be more difficult than establishing those connections in the first place: resignations are not accepted, officials and top managers in state organizations have to surrender their passports and are threatened with prison. Putin’s assurances that nobody will be prosecuted for opposing the war did nothing to allay the elite’s fears of a possible wave of repression. Businessmen and officials alike expect to see “disloyal” colleagues identified and made an example of in 2023.

One proposal that Putin himself discussed was an annual publication of “non-financial reports” for large enterprises. This would include details of what each company has done to invest in society, in a particular village, city or region. Putin spoke of this as investing in their country. Big businesses usually detail this as part of their ESG. Putin’s proposal included additional controls: “We will look at whether the money really went there.”

There were hopes that the headline grabber from the congress would be an agreement over a one-time voluntary payment from businesses into the state budget. However, nobody could agree on how, or how much, the payment should be (the figure is likely to be about 300 billion rubles, or $4 billion). Business leaders discussed this with Putin during the behind-closed-doors session. They still want it to be presented as a tax, so as not to appear to be voluntarily sponsoring the war, but there is still no final decision. A source familiar with what was said behind closed doors told The Bell that Putin continued to urge businesses to invest more in Russian projects.

Why the world should care

It doesn’t matter to what extent Russian business shares Putin’s goals – it will have to pay for them, and not just in taxes. On a federal level, this might mean a “voluntary” contribution to the budget; on a regional level it could be “social initiatives,” including some in support of the war in Ukraine. The state will track these “investments” via “non-financial reporting.” Putin and the Russian authorities spent much of the past year repeatedly demonstrating that they can do what they want with Russia’s elites.

Women and teens make up the labor shortage

Staff shortages have prompted Russian enterprises to start recruiting women and teenagers, according to the Central Bank’s February report on the state of the regional economy. For example, the Moscow region started recruiting women drivers in October 2022. Businesses in Siberia reportedly started to hire teenagers from age 16, as well as elderly candidates, on short-term contracts. The exact businesses involved were not specified.

Unemployment in Russia remains at a record low level of 3.6%. To attract and retain specialized staff, many businesses raised salaries last year, according to the document. It’s expected that 74% of businesses approached by the Central Bank will do the same this year, albeit on a smaller scale. The Bank of Russia has repeatedly warned that such wage increases run the risk of driving inflation.

There are several reasons for staff shortages in Russia. First, the military-industrial complex is poaching workers from the civilian sector. Second, in 2022, the number of new highly qualified specialists collapsed. Third is mobilization, although only 6% of respondents directly blamed a lack of staff on this. Finally, there are problems with “migration outflow and natural decline.”

Key figures of the week

- Prices went up 0.02% from March 7-13. Prices for fruit and vegetables continue to fall. Cucumber prices fell the most, down 10%. However, the cost of tomatoes went up (6.8%), and there were smaller price rises for onions (2.2%), bananas (1.7%), apples (0.5%) and beets (0.3%).

- The Federal Customs Service resumed the publication of foreign trade stats, albeit in a generalized form. Oil-and-gas exports rose 43% last year to reach an all-time high, but were matched by lower imports. The latter’s line-item performance confirms that 2022’s investment growth of 4.6% was an anomaly: equipment imports do not seem to be returning to normal.

- Service exports in nominal terms went down 12% in 2022. The Bank of Russia resumed publication of trade statistics not only for goods, but also for services. In the first two months of 2023, the decline was 43%. There was a comparable fall in imports: -8.6% in 2022 (goods imports -8.4%) but -39.7% in the first two months of 2023.

- Bank of Russia held its key interest rate at 7.50% p.a.

What to look out for next week

- Chinese President Xi Jinping visits Moscow

- Bank of Russia publishes its monthly monitoring of the value of enterprises (20/03)

- Estimate of inflation trends (20/03)

- Consumer expectations in Q1 2023 (22/03)

- Inflation from March 14-20 (20/03)

Further reading

- A Year of War Has Left Russia’s Elites Anchorless and Atomized Alexandra Prokopenko examines the state of Russia’s elites after a year of war

- Is Putin About to Get His Gas Union With Kazakhstan and Uzbekistan? Temir Umarov argues that it wouldn’t be easy for Russia to gain control over Central Asian exports to China

- Russia’s War Against Ukraine Is Catalyzing Internet Fragmentation Christoph Meinel and Dr. David Hagebölling see signs of internet fragmentation in Russia’s possible decoupling from the global web

- The Russia That Might Have Been Alexander Gabuev analyzes how Moscow squandered its power and influence

- Moldova’s Fragile Security Situation Anastasia Pociumban provides a comprehensive analysis of key challenges for the the government of Moldova

The author of this newsletter is one of Russia’s leading writers on this topic: independent economic analyst Alexandra Prokopenko. Alexandra worked as an advisor at Russia’s Central Bank and Moscow’s Higher School of Economics from 2017 to 2022 — and before that she was an economic journalist for Vedomosti, then Russia’s leading business newspaper. Today, Alexandra is a columnist at the Carnegie Endowment for International Peace and a visiting fellow a the Center for Order and Governance in Eastern Europe, Russia, and Central Asia at the German Council on Foreign Relations. She holds an MA in Sociology from the University of Manchester.