Sanctions against oligarchs are more painful for the Russian economy than expected

Sanctioned billionaires Viktor Vekselberg and Oleg Deripaska. Photo credit: TASS

1. Sanctions against oligarchs are more painful for the economy than expected

What happened

Last week was unexpectedly turbulent for the Russian economy. After the publication of the “Kremlin List” at the end of January, which the world waited half a year for, and which didn’t really create any real trouble for those mentioned in the list, Russia’s elite relaxed a bit. The sanctions announced last Friday against seven Russian billionaires were a shock not only for the oligarchs themselves, but also for the entire Russian economy. The new sanctions didn’t just hit Putin’s friends who made their billions with state contracts inside Russia; they targeted the owners of multinational publicly traded companies — and the Russian market immediately felt the difference.

- The Moscow Exchange index fell by 9.4% from Friday to Monday, a record loss not seen since March 2014, when Crimea was annexed.

- The Russian rouble fell by 11.8% vs. the U.S. dollar in just three days — also not seen since December 2014.

Who suffered the most?

- Right after the new sanctions were announced, The Bell spoke with people named in the Kremlin List and they all said in unison: Oleg Deripaska will suffer the most. Actually, you don’t have to be on the Forbes list to come to this conclusion. The Bell named Deripaska one of those most likely to be included on the list already last fall — because of his connection to Paul Manafort, and because of long-held American suspicions of his connections to organized crime. After the publication revealing how the billionaire vacationed on a yacht with a deputy prime minister and discussed the U.S. election, there was really no doubt that Deripaska would be named.

- The irony, though, is that Deripaska is one of the most “global” Russian billionaires. His most important asset is Rusal, one of the world’s largest producers of aluminum. Rusal, and En+, the holding company also controlled by Deripaska, both trade on international exchanges. Rusal exports 82% of its production, 92% of the company’s debt is U.S. dollar denominated, but now any foreign company, bank or buyer of aluminum is at risk of secondary sanctions if it conducts business with Rusal.

- On the first day of trading after the sanctions announcement, Rusal said it might default on its debt payments. The company’s shares fell by 50% on the Hong Kong exchange in a matter of minutes. Rusal’s market cap is now $4.4 bn, while just in September 2017 it toped $12 bn. En+ shares in London fell by 30%, at which point the exchange halted trading in the company’s shares. Five international traders stopped buying aluminum from Rusal, and Ivan Glasenberg, the CEO of Glencore, Rusal’s primary trader, which owns 8.75% of Rusal’s shares, resigned from Rusal’s board of directors. In other words, Oleg Deripaska is facing a real catastrophe — Bloomberg’s estimate that he lost $2 billion of his net worth appears modest.

- A more unexpected member of the sanctions list, as we already mentioned, was Deripaska’s partner in Rusal, Viktor Vekselberg. Vekselberg is not known to have particularly close ties, when compared to other Russian oligarchs, to Putin. Yet his American partners and managers did help finance Trump’s presidential campaign. According to Bloomberg estimates, Vekselberg’s net worth fell from $16.4 to $14.9 billion. Most of the loss was attributable to the fall in Rusal shares; Vekselberg owns 26.5% of the company. In other areas, Vekselberg shouldn’t suffer such great financial losses, according to a colleague from the Russian Forbes list: Vekselberg should have significant cash reserves, and most importantly — he doesn’t own more than 50% stakes in large publicly traded companies. The only exception is the Swiss machine building company, Sulzer, but on the first day of trading following the announcement of sanctions, Vekselberg sold 14.59% of the company (from his original 63.42% stake), and now he is in the clear.

- Another billionaire on the list is a member of Russia’s upper house of parliament, Suleiman Kerimov, who already had legal trouble with authorities in Europe prior to the introduction of U.S. sanctions. In November of last year, he was arrested in France and is accused of illegally bringing millions of Euros into the country – suitcases each filled with €20 million in cash, money laundering through purchases of expensive real estate on the Cote d’Azur, and tax evasion to the tune of €400 million. A former oil trader, in the mid-2000s Kerimov made billions buying Gazprom and Sberbank shares with credit, but then he almost lost everything after buying large stakes in major western investment banks just before the 2008 crisis. Kerimov’s current net worth is estimated to be $4.4 billion (down from $5.1 billion since sanctioned); his main asset is the gold mining company, Polyus Gold, which is controlled by the senator’s relatives. Kerimov has also invested in American companies, for example, Snapchat.

Who else is in the list

- Vladimir Bogdanov ($1,9 billion) — CEO of Surgutneftegas, Russia’s third largest and most secretive oil company. Surgutneftegas is famous for two things: first, it is the only major Russian company which, via subsidiaries, owns itself, second — it is the only oil company which saves almost all of its profit on its balance sheet and has already set aside almost $40 billion in cash. Unofficially, Surgutneftegas has a reputation as Vladimir Putin’s piggy bank.

- Andrei Skoch ($6,9 billion) — a member of Russia’s upper house of parliament and long-time junior partner of billionaire Alisher Usmanov. It is surprising that he was included in the list — Usmanov is far more influential and closer to the Russian government. The American authorities suspect that Skoch long maintained relations with Russian organized crime groups, and even led one of them (it is likely they are referring to the “Solntsevo” group) .

- Kirill Shamalov ($1,3 billion) was a victim of his connection to Vladimir Putin’s family — until last year, he was married to the president’s daughter, Katerina Tikhonova. During the time he was married to her, Shamalov managed to become the owner of a fortune worth $1.3 billion, having bought a 20% stake in the petrochemical company Sibur (using debt financing). Last year, Shamalov divorced Tikhonova, sold his stake in Sibur, and repaid his debt — in total, according to various estimates, Shamalov is believed to have made between $0 and $200 million on the trade.

- Igor Rotenberg ($700 million) paid for his father’s generosity. He is the son of Arkady Rotenberg, a friend of Putin’s, who has been subject to U.S. sanctions since 2014. When he was sanctioned, Rotenberg senior passed some of his assets to his son. He is now estimated to be worth $700 million.

What other oligarchs are saying

- The Bell spoke with other Russian billionaires who weren’t named on the list, and their opinions varied.

- One believes that Russian business can relax for now, assuming that there won’t be new, significant worsening of relations with the U.S. Actually, according to his logic, those oligarchs named on the list could have relaxed earlier. “I don’t think they really could have done anything ahead of time to prevent being named on the list,” he said.

- Another billionaire named on the Kremlin List and an acquaintance of one of the oligarchs who came under U.S. sanctions, disagrees, and is convinced that the U.S. will continue to announce personal sanctions against businessmen, step by step.

- “Just because the partners of those who were named on the list didn’t make it there this time, doesn’t mean that they won’t be named in the next round of sanctions; actually, this means only one thing — they will for sure be named in the next round,” argues the billionaire not yet included on the list. He looks towards a potential future under sanctions without optimism: once you are named on the list there will be no new deals, banks will stop lending to you, and even transferring businesses to relatives won’t save you, he explained.

Why the world should care

The near term consequences of the new sanctions can be estimated by looking at the Russian market’s reaction. It’s difficult to estimate the long term consequences, but it seems that Russian oligarchs are facing a difficult choice: either remain in isolation in Russia (the state already offered the victims internal offshore zones in Russia with favorable conditions), but live under FSB control and under the threat of felony charges in the event of any conflict, or transfer assets to the West, which, as the fate of billionaire Ziyavudin Magomedov illustrates, is no less risky.

2. Russians experienced the biggest currency shock of the last 4 years — and they handled it calmly

What happened

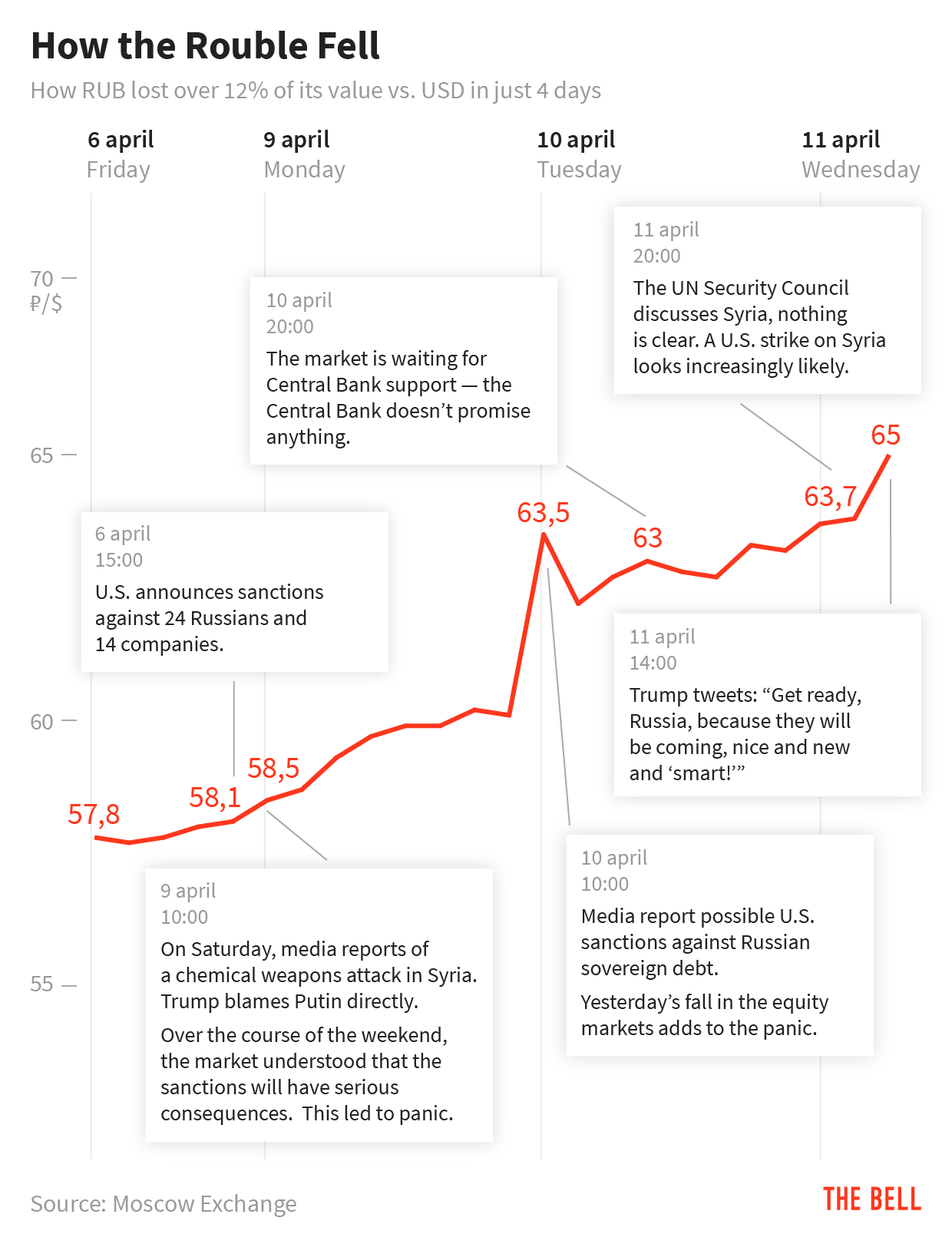

Russians followed the rouble exchange rate closely all week – it began to fall on Monday, on the news of new U.S. sanctions, and Donald Trump’s tweets and escalation of the Syrian conflict only worsened the situation. This is how it looked at the peek:

- The graphic shows that more than anything else, investors were scared by potential U.S. sanctions against Russian sovereign debt. Although this action seems rather unlikely, it was enough to drive a new sell-off of the Russian currency.

- Financial analysts said every day, starting from Monday, that with Brent at $71 the rouble cannot fall that quickly, and the next day it would bounce back. Only by Wednesday, they had to accept the fact that Donald Trump’s Twitter account has a greater impact on the Russian currency than any fundamental economic factors. “We can’t predict where the rouble will be in five minutes: that is totally dependent on geopolitics,” an analyst with Nordea told (Russian) The Bell.

What Russians think

- The rouble exchange rate is something almost sacred for Russians. Citizens remember too well the 2014 crash of the national currency, the result of sanctions and falling oil prices, when the rouble fell by 40% vs. the dollar. Most of the decline took place over a period of just a few days at the end of the year.

- At the time, this caused a real panic among a population which had gotten used to stability in the exchange rate: as the rouble fell, people bought foreign currency, imported electronic goods (mostly televisions) and cars. But the real drama was experienced by those who took out foreign currency denominated mortgages prior to the crisis to buy real estate. Those people flooded into their bank branch offices, demanded the Central Bank and government respond, and staged public protests.

- This time, a mass panic was avoided, and by the end of the week the rouble began to show small gains.

Why the world should care

It is surprising that for a moment the rouble exchange rate untied itself from the price of crude, which it usually always follows. Geopolitical factors play such a role in modern Russia that the rouble continued to fall even when crude prices reached $73 per barrel for the first time in three years. Crude is also rising over investor concerns regarding potential escalation of the conflict in the Middle East. But if the conflict doesn’t blow up, Russia only benefits from Donald Trump’s tweets (it’s difficult to describe them properly).

3. Russian business loses support in Syria, and after a strike in the U.S., won’t be able to make money off of Assad

What happened

While oligarchs calculated their losses, and traders unsuccessfully tried to predict where the rouble would go, Russian state television channels showed programmes (Russian, English subtitles) about what things you should take with you to a bomb shelter in the event of a nuclear war. The accent, of course, was ironic, and the hosts said that the real panic wasn’t in Russia but rather in America. But the fear of a conflict with the U.S. over Syria became the second main theme in the news this week after the fall of the rouble.

Of course, in reality no one is planning to go to bomb shelters, and the possibility of World War III isn’t taken seriously by anyone other than conspiracy theorists. But for Russian businesses in Syria, which hoped to make money with the help of Russia, grateful for the salvation of the Assad regime, things don’t look good. In the event of a conflict, they might lose the opportunity to work in Syria at all.

- The first strike against Russian-Syrian business interests was made without the help of rockets. Not many paid attention to the fact that the new U.S. sanctions list included RFK Bank, which is owned by Russia’s weapons exporter, Rosoboronexport. However, The Bell learned (Russian) that most of the payments between Russia and Syria flow through this bank — and not just for the sale of weapons. Other state-run banks avoid cooperation with Syria, as there is already the precedent of U.S. sanctions for engaging in similar activities.

- It is not yet clear if this will halt cooperation between Russia and Syria, which both countries have promised to seriously increase. For transactions, they could use banks from Lebanon, Egypt or the UAE, but losses on currency conversion would be too large, explained one person with whom The Bell spoke.

- Actually, in the event of a U.S. attack on Assad, the loss of a transaction bank would appear to be only a small problem. “If the Americans begin to bomb Syria, it will immediately become unattractive for any type of business,” businessman Alexander Ionov told The Bell. Ionov supplies Russian-made products to Syria. “Of all the major projects, investors will only be interested in crude oil – just like now in Libya.”

- A year ago, major Russian companies planned serious projects for Syria, but many of the announced projects never got off the ground. Billionaire Gennady Timchenko’s “Stroitransgas” (he has been under personal U.S. sanctions since 2014) planned (Russian) to mine phosphates in Syria, but now the company claims that it isn’t carrying out any kind of work in Syria. The pharmaceutical company “Biokad” won in 2016 a tender worth $4 million to supply oncological medicines to Syria, but it still hasn’t begun deliveries due to delays with documentation.

Why the world should care

It would be naive to think that Russian business interests in Syria could be one of the deciding factors in preventing a conflict between Russia and the U.S., but if this could be even one factor, it wouldn’t hurt.

4. A court blocks Telegram in Russia, the elite’s most popular messenger service

This morning a Moscow court blocked the messenger Telegram in Russia. Telegram refused to pass its encryption keys for users’ messages to Russian state security services. This is the first attempt in Russia to block, Chinese-style, a widely used service with millions of active users. Telegram is very popular among residents of Russia’s largest cities, and ironically, is particularly popular among the government elite.

- Russian authorities began to threaten Telegram with a block one year ago. Then, the company refused to provide information for a registry of messengers which the government was beginning to compile.

- The messenger was founded by the programmer Pavel Durov, who earlier founded Russia’s most popular social network, VKontakte. The company’s marketing strategy is centred on the confidentiality of correspondence and the company’s total refusal to cooperate with government authorities.

- The conflict with the government only made Telegram more popular — between April 2017 and March 2018, its user base in Russia grew (Russian) tenfold, from 1.9 to 8.7 million users.

- A particular defining characteristic of Telegram in Russia is the high quality of its audience base. Telegram is used by highly educated residents of large cities, in many large companies it is the primary channel for corporate communications, and thanks to its reputation as a “safe” messenger, Telegram is also used by the majority of government officials. They, more than ordinary citizens, fear security services’ surveillance. Another particularity — Telegram became the most popular platform in Russia both for traditional media and for media outlets created specifically for Telegram. Major Telegram channels reach audiences in the hundreds of thousands.

- Pavel Durov’s determination in the conflict with the authorities can be explained by the fact that Russia isn’t Telegram’s most important market. Telegram is currently undertaking the world’s largest ICO and has already sold $1.7 billion of tokens. The refusal to cooperate with Russian security services can boost the messenger’s reputation globally and lead to user growth.

- In March, Telegram announced that its global audience reached 200 million people. The highest number of these — at least 40 million users — are in Iran. In Iran, local authorities constantly try to block the messenger. But during the last block, in January 2018, traffic fell by only 20% — the majority of users were able to get around the block with the help of VPNs and proxy servers. Now Russian users are doing the same.

Why the world should care

Blocking Telegram is the first attempt by the Russian authorities to ban a truly widely used service which is popular among a politically active audience. The events show just how realistic it could be for Russia to build an analog to the “Great Chinese Firewall”, which the security services dream about.

Peter Mironenko, The Bell

This newsletter is made with the support of the Investigative Reporting Program at UC Berkeley.