Top 5 Russians who got rich from departing Western firms

Hello! Welcome to your weekly guide to the Russian economy brought to you by The Bell. Our top story is a ranking of the top five Russian tycoons who have acquired the most assets as a result of the wartime departure of Western companies. We also look at some of the speculation about a government reshuffle that is expected to follow presidential elections.

The Bell ranks those who gained most from wartime exodus of Western firms

The departure of Western companies from Russia after the invasion of Ukraine enabled a select group of Russian tycoons to acquire valuable assets for next to nothing. These men and women are made up not only of familiar oligarchs and Putin’s friends, but an emerging business elite – often ambitious, mid-ranking businessmen with government connections. The Bell has compiled a rating of these new tycoons. Here are the top five:

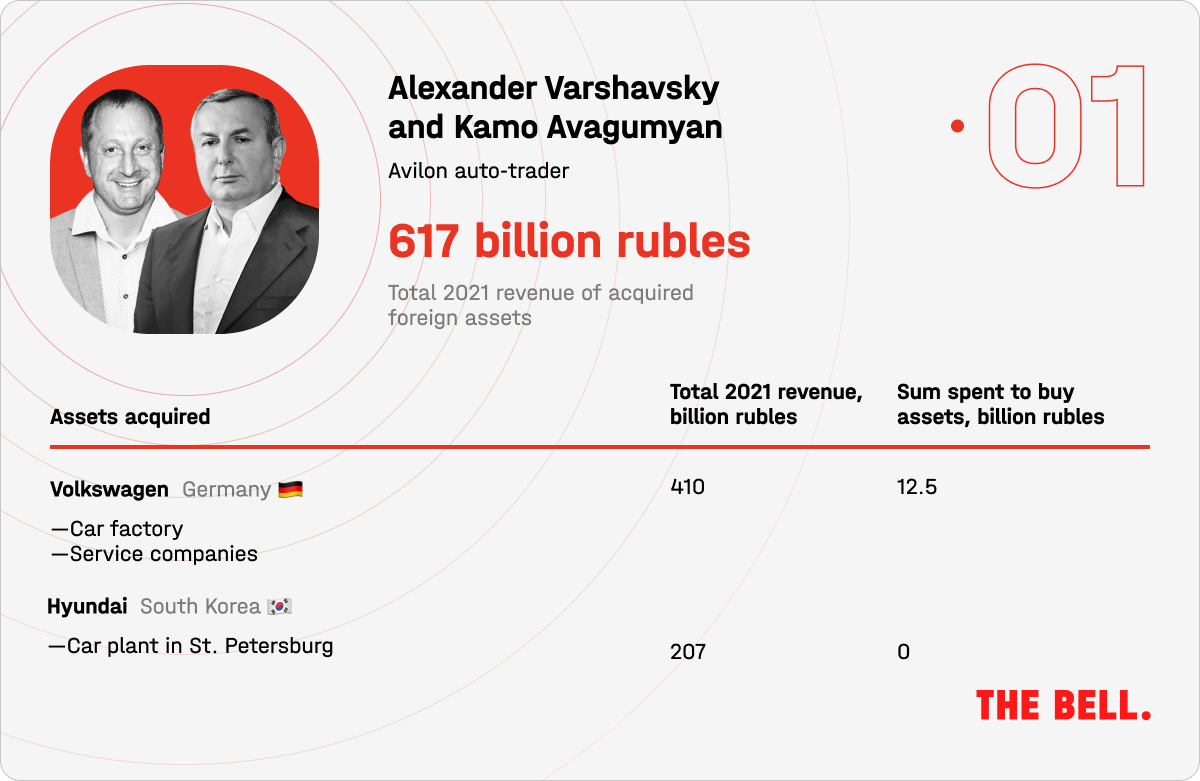

1. Alexander Varshavsky and Kamo Avagumyan

The founder of auto-trader Avilon, Alexander Varshavsky, has an unusual biography for a Russian businessman. A naturalized American from a migrant family, he moved to Russia in the mid-1990s and was one of the founders of Moscow Taxi – the first privately-operated taxi fleet in the capital. That company collapsed in the 1998 financial crisis, and co-founder Simon Garber, New York’s “Taxi King,” went back to the United States. Varshavsky stayed in Russia, opening his first auto dealership, New York Motors.

By the early 2000s, Varshavsky’s company was one of the leading Ford dealers in Russia, and he had reached a deal with Mercedes-Benz. Renamed Avilon, it started building a large dealership on Moscow’s Volgogradsky Prospekt. This is when Kamo Avagumyan, a former Armenian prosecutor, joined the team. Varshavsky and Avagumyan currently each own 50% of Avilon via foreign holding companies.

Varshavsky and Avagumyan built their business thanks to good relations with Russian officials. Avilon’s main clients remain the law enforcement agencies. In particular, they have a special relationship with Russia’s Prosecutor General’s Office – Avagumyan even jointly owned a hotel in Greece with the son of Prosecutor General Yuri Chaika. That hotel featured prominently in corruption investigations by deceased opposition leader Alexei Navalny.

In 2014, Varshavsky, who had spent 20 years living between the U.S. and Russia, was arrested in the U.S. and charged with concealing information about his foreign accounts and evading taxes. After his arrest, the businessman “realized that he was not welcome in the U.S. and returned to Russia,” according to a former business partner.

Until the full-scale invasion of Ukraine, Varshavsky and Avagumyan were significant but not dominant figures in the car dealership market. However, the war transformed them into Russia’s biggest owners of car factories as they acquired the plants of Volkswagen and Hyundai (together 32% of the pre-war Russian car market). They acquired the Volkswagen plant for one twelfth of its market value, while the Hyundai factory cost 10,000 rubles ($108).

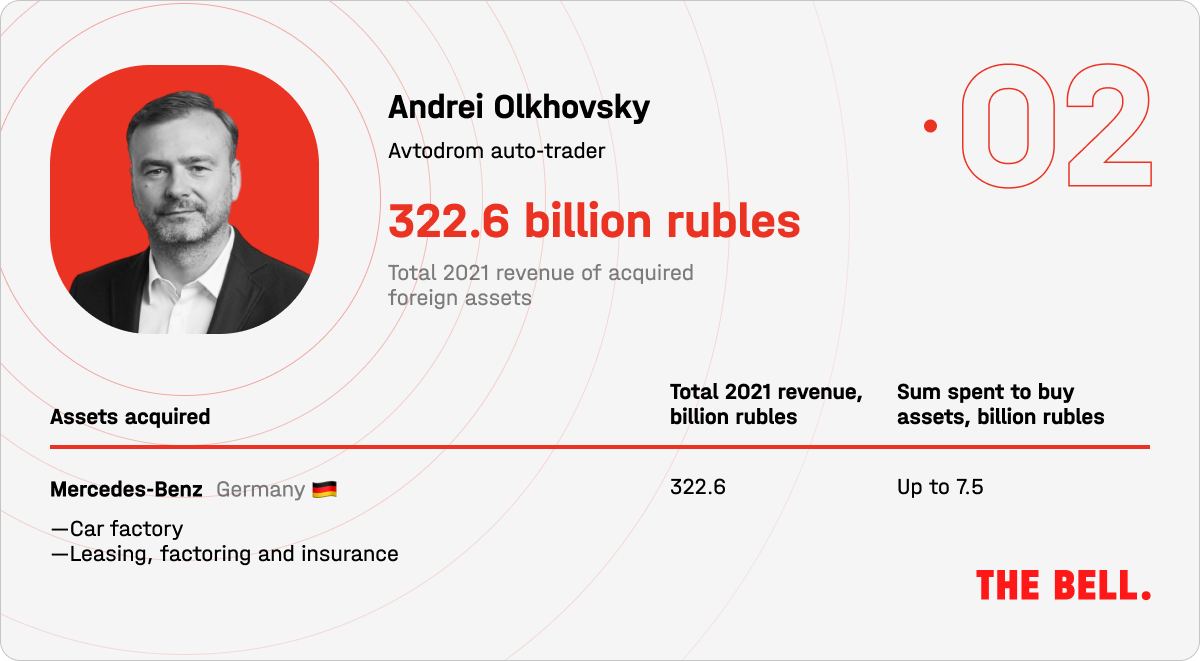

2. Andrei Olkhovsky

Andrei Olkhovsky was born and educated in the Siberian city of Omsk. Initially, he was involved in non-ferrous metals, construction and real estate rental. In the mid-2010s, he moved into car dealing. Today, he is owner and managing director of Avtodrom, which is among the top five dealerships in Russia and specializes in premium vehicles.

In 2023, Avtodrom acquired Mercedes’ Russian business, gaining, in the businessman’s words, “the most contemporary factory you could imagine.” Mercedes retains a buy-back option. Olkhovsky admitted in a recent interview that re-launching the car production line will be a “big challenge,” and that much work remains to be done. “We need to set up our own processes so Russian companies can operate comfortably. This will probably be some kind of compromise between the Chinese approach and our approach,” he said.

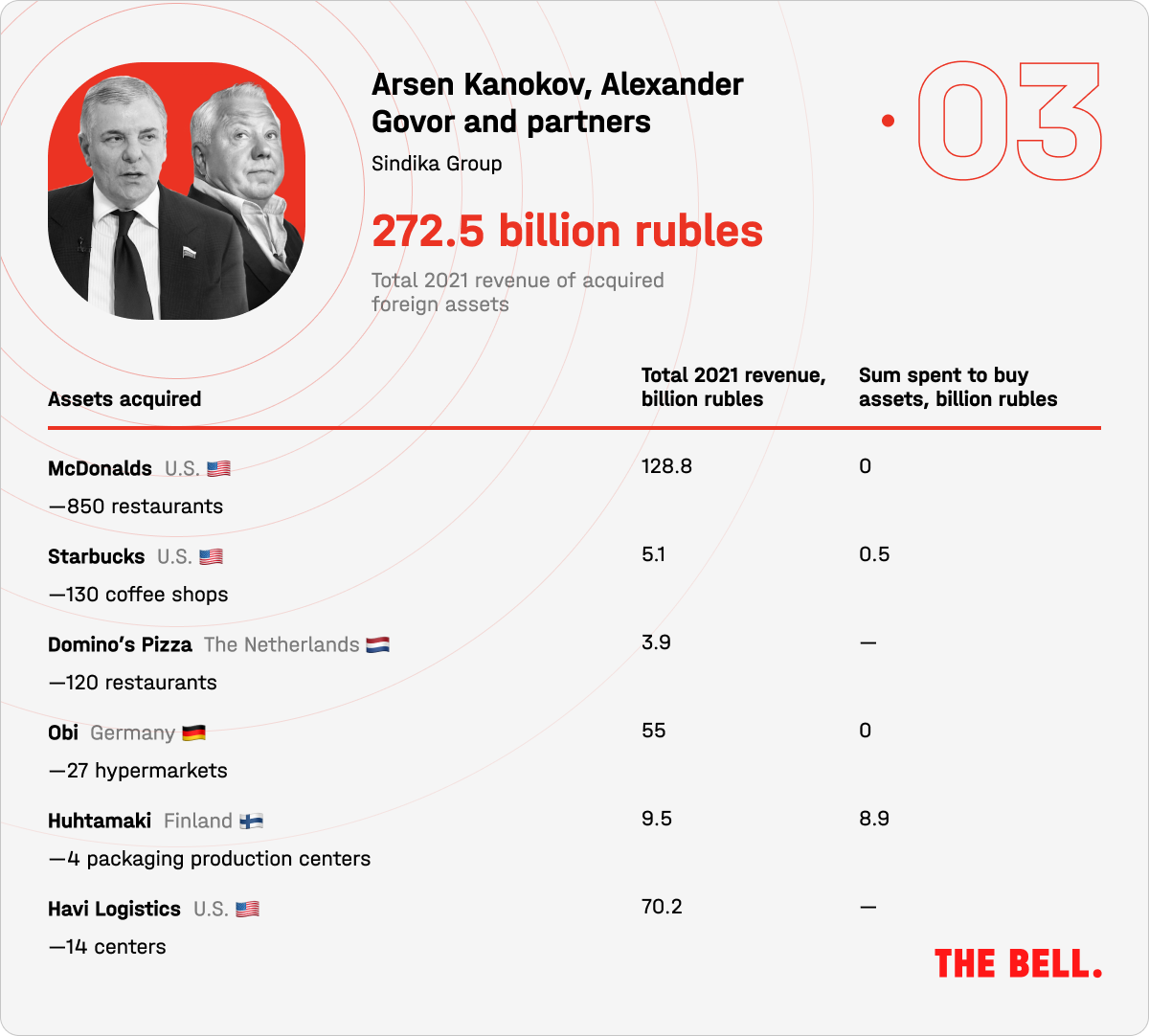

3. Arsen Kanokov, Alexander Govor and partners

Arsen Kanokov, former head of the North Caucasus republic of Kabardino-Balkaria, senator and founder of Sindika holding, began his career in fruit and vegetables. He now owns a dozen hotels, shopping malls and restaurants.

When it comes to snapping up foreign assets, Kanokov prefers to stay in the shadows. Nonetheless, he has had a hand in several major transactions. In May 2022, billionaire Alexander Govor was revealed as the buyer of Russia’s McDonald’s – 18 months later, it emerged the management company included those working for Kanokov. The OBI hypermarket chain changed ownership three times after its German parent company exited Russia, ending up in the hands of a company connected with Sindika. And Kanokov jointly bought the Starbucks chain in Russia with restaurateur Anton Pinsky, and rapper Timati.

Crucially, one of the minority shareholders in OBI and Starbucks turned out to be Adam Delimkhanov, the right-hand man of Chechen leader Ramzan Kadyrov.

4. Ivan Tavrin

Last year, news agency Bloomberg named Ivan Tavrin as the biggest buyer of assets left behind by foreign companies as they exited Russia. The agency calculated that, in the first year of the war alone, Tavrin spent about $2.3 billion on such assets.

Tavrin made his fortune in the media market. At the end of the 1990s he sold advertising on regional television and in the early 2000s he began to buy channels. In 2009, Tavrin partnered with billionaire Alisher Usmanov in the TV business. Then, in 2012, he took charge of one of Usmanov’s biggest assets – telecoms giant MegaFon. In the late 2010s, Tavrin’s portfolio included several major Russian internet companies and in the 2020s he became the largest owner of cell towers in Russia.

During the war, Tavrin and his partners bought the assets of chemical manufacturer Henkel, the developer of the Fleetcor fuel payment service, and Melon Fashion Group, which managed the Sela, Befree and Zarina fashion brands. But his biggest acquisition was the highly-profitable Avito, Russia’s largest online marketplace. Few expected him to be able to keep such a juicy asset, but, so far, he remains in control.

Many media reports have identified Tavrin as one of the potential buyers of Yandex. Tavrin has always denied he is interested. However, we may never know who eventually acquires Russia’s largest IT company since its buyers look set to remain hidden.

5. Igor Sechin

We spent some time debating whether Igor Sechin should be included in this ranking. After all, neither he, nor state-owned oil giant Rosneft, which he runs, paid a kopeck for anything. As a result of a presidential decree, the assets of foreign energy forms Fortum and Uniper’s were officially not nationalized but temporarily placed under the external management of the Federal Property Management Agency – Rosneft received these assets as a temporary manager. That means all the cash flows are controlled by Sechin’s people.

Fortum and Uniper’s assets represent almost 5% of Russia’s total electricity generation capacity; before the war they were valued at $5.5 billion.

Fortum was willing to give up its Russian assets voluntarily, but was not allowed to do so. In 2022 the company announced the sale of its Russian business (including Uniper’s assets). However, the sale was blocked by a presidential decree that banned Western investors in certain industries from selling up without special permission.

It appears that Sechin himselfcame up with a mechanism to put foreign assets under external management. This was in response to the seizure of Rosneft and state-owned gas giant Gazprom assets in Germany.

How we did the calculations

Our valuations are based on financial statements issued by Russian legal entities that were once owned by Western companies. The list includes only Russian citizens who purchased foreign assets that had total revenues greater than 10 billion rubles in 2021. Business partners were treated as a single group.

The rating does not include deals with the senior management of departing foreign companies (these deals usually mean the foreign investor could return), nor cases where foreign shareholders left a joint venture with Russian shareholders. We also did not include real estate transactions because these are difficult to evaluate. We also excluded sales of Russian businesses registered abroad (such as Tinkoff Bank).

Expectations grow of post-election government reshuffle

Russia’s three-day presidential elections kicked off Friday. While there will be no surprises about the winner – Vladimir Putin – there is much speculation about a subsequent government reshuffle. It seems unlikely that Prime Minister Mikhail Mishustin will be replaced, but there look certain to be some changes in his cabinet.

- Many staffing decisions have been postponed due to the war, and, in the meantime, officials have been seeking to bolster their credentials, for example, by taking an interest in Russian-occupied Ukraine. However, big changes could lead to dysfunction. “Replacing Mishustin in this situation is more of a risk than an opportunity,” a source close to the Kremlin told The Bell. However, if there is a change, candidates for the prime minister role include Sergei Kiriyenko, Putin’s deputy chief of staff, and Maxim Oreshkin, an economic aide to the president.

- News agency Bloomberg reported Tuesday that Agriculture Minister Dmitry Patrushev – son of the influential Security Council head Nikolai Patrushev – could be made a deputy prime minister. Bloomberg’s sources also predicted a promotion for Deputy Prime Minister Yury Trutnev.

- “Putin trusts [Finance Minister Anton] Siluanov, and [Trade and Industry Minister Denis] Manturov, and [Central Bank head Elvira] Nabiullina,” one official, who laid out the argument for relatively minor changes, told The Bell. According to him, the president regularly shields the heads of the government’s economic ministries from attacks by tycoons, businessmen and the security forces.

- However, others believe now is the moment for a big shake-up. “Russia successfully adapted to sanctions, and the economy has emerged from the crisis. Now we need an aggressive government policy… ‘Mr. No’ Siluanov and systemic liberal Nabiullina are not up to the task,” said another official. “Where is the dollar now? We do everything with yuan. It turned out that there was someone on whom we could rely in this world. Sure, it’s not as quick and not as cheap as we’d like, but it works.”

- Political expert Tatiana Stanovaya said that a reshuffle could accelerate a process whereby younger, more hawkish officials are beginning to eclipse the “old guard” that have surrounded Putin for decades.

- Whatever happens, the new government will face some challenging tasks: cool an overheating economy, while at the same time maintaining funds for the war and supplies for the front – but without risking macroeconomic and social stability. The first unpopular decision on the government’s agenda is already clear: deciding on tax rises. Putin, who warned of tax hikes in his recent state-of-the-nation, has carefully avoided going into any specifics on this issue.

Why the world should care

After Russia’s 2018 presidential election – also in March – a new cabinet was unveiled on May 7. So, it could be several months before we know about any changes. Either way, the Russian elite expects an update, and reshuffles are a way of letting off steam.

Figures of the week

- Citing two sources, independent media outlet iStories reported Monday on one way of raising taxes that is currently under discussion in the government. It’s not very radical. In this scenario, income tax would remain at 13% except for those earning over 1 million rubles a year (roughly the average salary in Moscow) who will have to pay 15%, and those earning over 5 million rubles a year who will be taxed at 20%. At the same time, the government would increase corporate income tax from 20% to 25% (a change that would raise far more than the income tax hikes).

- Gasoline prices in Russia this week reached their highest level in six months. Prices are rising amid a series of successful Ukrainian drone attacks on major Russian oil refineries. This week alone, drones damaged oil company Lukoil’s refinery in Nizhny Novgorod, Rosneft’s refinery in Ryazan as well as a refinery in Novoshakhtinsk owned by the family of pro-Russian Ukrainian politician Viktor Medvedchuk.

- Putin announced Thursday the start of building work for a new high-speed railway link between Moscow and St. Petersburg. This was more than just pre-election PR: the authorities want to make progress on an infrastructure project that has previously been a symbol of profiteering and corruption. As much as 2 trillion rubles has been earmarked for the project, which will be carried out by Lider, a company owned by Putin’s friend, billionaire Yuri Kovalchuk.

Further reading

Russian authorities seek strong election showing for Putin

Forever Putinism. The Russian Autocrat’s Answer to the Problem of Succession