The Potemkin village at this year’s SPIEF

Hello! This is Alexandra Prokopenko with your weekly guide to the Russian economy — brought to you by The Bell. This week we focus on the atmosphere of enforced optimism at this year’s St. Petersburg International Economic Forum. We also look at why the Central Bank believes the economy might be overheating.

The decline and fall of the St. Petersburg International Economic Forum

It’s two weeks until this year’s St. Petersburg International Economic Forum (SPIEF), the main event in Russia’s business calendar. Organizers usually call SPIEF the “Russian Davos” in an attempt to hype it up. However, in the past couple of years, the gathering has become less and less international. The absence of high-ranking guests from the West is no surprise, but this year is also notable for a dearth of top Middle Eastern officials — and even the lack of many executives from leading Russian companies.

Who’s going?

SPIEF organizers are doing all they can to attract top-tier guests. Before the war, the leader of the partner country traditionally took part in a plenary session with President Vladimir Putin. In 2017, this was Indian Prime Minister Narendra Modi, in 2018 it was Emmanuel Macron and in 2019 Xi Jinping did the honors. Last year’s partner — Egypt — was not such a big hitter and Egyptian President Abdel Fattah al-Sisi stayed home; sending only a video message. The only leader who shared a stage with Putin last year was Kazakhstan’s Kassym-Jomart Tokayev. This year’s official partner country is the United Arab Emirates (UAE) but we don’t yet know whether anyone from the UAE will take part in the plenary session. We only know that Putin is expected to be there in person.

One Russian official said that foreigners are reluctant to sign up. “It’s not just the West… frankly there are not many from the BRICS countries," he said. Another official added: “Nobody is talking about coming… This year, we will only know when we get to the venue.” The public guest list is dominated by names from the UAE, Saudi Arabia, India and China.

The preliminary line-up for this year’s forum that was leaked to FT included several top names from the West, including former Google boss Eric Schmidt. They all said they weren’t planning to attend. Aside from Schmidt, the program promised talks by Lucid Motors director Peter Rawlinson, Stanford professor Ilya Strebulayev, British computer scientist Stephen Wolfram, renowned AI researcher Eliezer Yudkowsky and former U.S. Undersecretary for Veterans’ Affairs Sloane Gibson. Schmidt attended SPIEF 2011, but this time he never even received an invitation, a source told the FT. Strebulayev, who left the Yandex board of directors last March, said that he knew nothing about an invitation. Yudkowsky said that he received an invite but did not respond because he supports Ukraine.

In April, Putin’s press secretary Dmitry Peskov said several businessmen from Western countries were “very interested” in attending, but that the Kremlin could not announce their names in advance for fear that back home “they would be eaten alive.” To protect guests, the organizers have also apparently refused to issue accreditation to some reporters from “unfriendly” countries, The Bell reported, citing journalists from the U.S., France and Germany.

Russian companies, for whom a lavish SPIEF budget was once a matter of honor, are also turning their backs. For the second year running, Yandex is skipping the forum. Roskosmos and Russian Post decrease their presence.

The main event is a session with Putin: admission is only by special invitation, following rigorous security checks. Before the war, Russia’s business elite jockeyed for positions at the session with Putin where they might be spotted by the TV cameras. Last year, though, the most popular seats were further from the action, several prominent participants told The Bell. “If it was possible, we wouldn’t have gone at all, but that would have been too noticeable,” one businessman said.

How much does it cost?

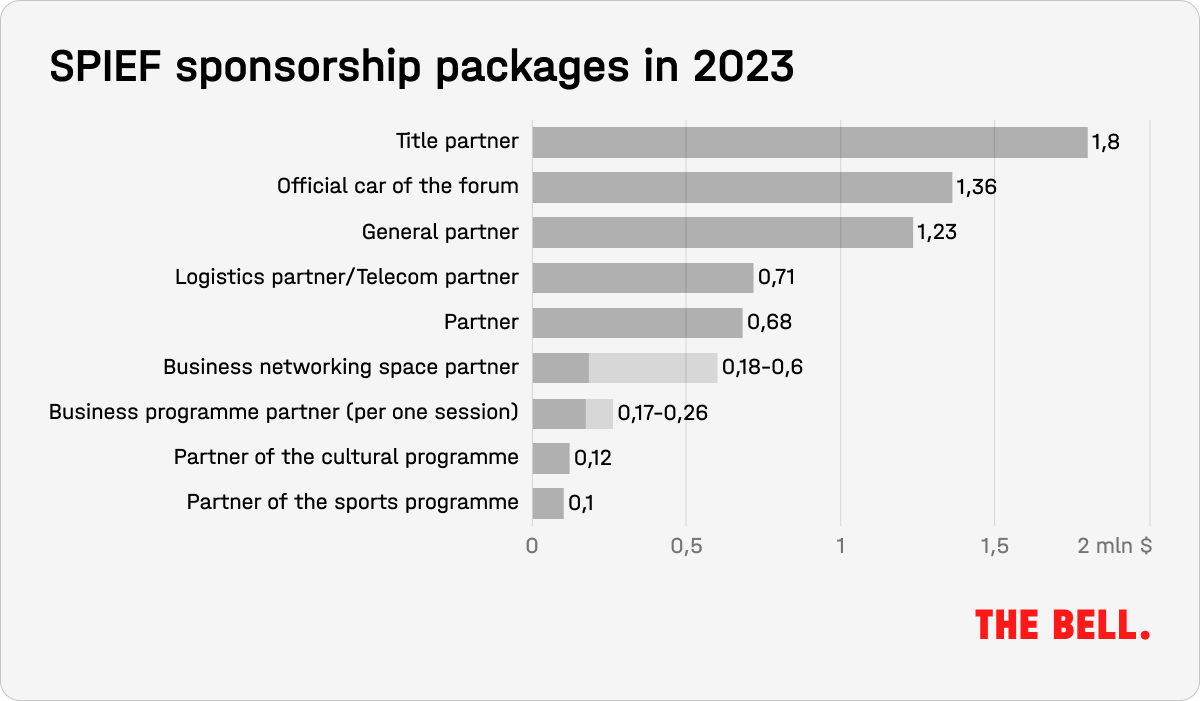

The cost of renting a stall at SPIEF this year is up as much as 15% on last year, according to a price list seen by The Bell. The most expensive sponsor role (taken this year by state development bank VEB and nuclear energy company Rosatom) costs 145 million rubles ($1.8 million). A general partnership can be had for 100 million rubles ($1.25 million). For individuals, participation costs 1.1 million rubles ($13,700).

What will be discussed?

The major topic of last year’s SPIEF was sanctions. At two panels, representatives of the government and business discussed whether this was a chance for Russia’s economy to modernize — or whether it would simply degrade. Would Russia become a gas station for China? The Kremlin was upbeat. Putin stated that “it’s not possible to bring down the economy”, and Kremlin economic advisor Maxim Oreshkin urged everyone to “believe in Russia.”

Strikingly, though, the reason for sanctions against Russia — the war in Ukraine — was never mentioned. The word “war” doesn’t appear in this year’s program either, and even the euphemistic “special military operation” is seldom seen. Instead, we have weasels words about “prevailing conditions,” “new realities,” “familiar events” and so on.

This is no accident. It supports the common illusion among the Russian elite that sanctions appeared all by themselves due to the “ill-will” of those who imposed them. As a result, in the whirlwind of day-to-day life you can busy yourself with anti-crisis measures and never reflect on the cause of the crisis. Indeed, the country’s leadership suggests that there is no crisis, merely a few passing difficulties that will only make Russia stronger.

In private, officials usually shrug their shoulders and complain everything is going to the dogs. At the same time, in public, they say completely different things. And this macabre dance leads to greater uncertainty and inertia. Nobody wants to do anything until there is some kind of clarity about sanctions (will they be gradually removed, or maintained and strengthened?) or on issues of economic development.

If you took SPIEF’s 2023 program at face value, you’d conclude that Russia has already dealt with all its problems and a bright future beckons. The program appears to focus on a few key areas: the economy; building tech sovereignty; the labor market’s response to new challenges; and quality of life.

Revealing, there is one session dedicated to the problems of reintegrating servicemen returning from the fighting in Ukraine. Although employers are complaining about labor shortages, the government still has no proper policy for reintegrating ex-servicemen. Another big problem on the labor market — the competition for staff between the civilian sector and the military — is not being discussed at all. “Nobody will discuss any kind of problem, everything should be as optimistic as possible,” said one official.

Why the world should care

Legend has it that when Catherine the Great toured her new territories on the Black Sea (part of modern Ukraine), Prince Grigory Potemkin hastily assembled fake villages to impress the Empress. SPIEF 2023 and its enforced positivity are fulfilling a similar role for Putin. This “21st century Potemkin village” is the Kremlin’s desperate attempt to prove that Russia has foreign partners and that its economy is dynamic.

Central Bank sees danger of economy overheating

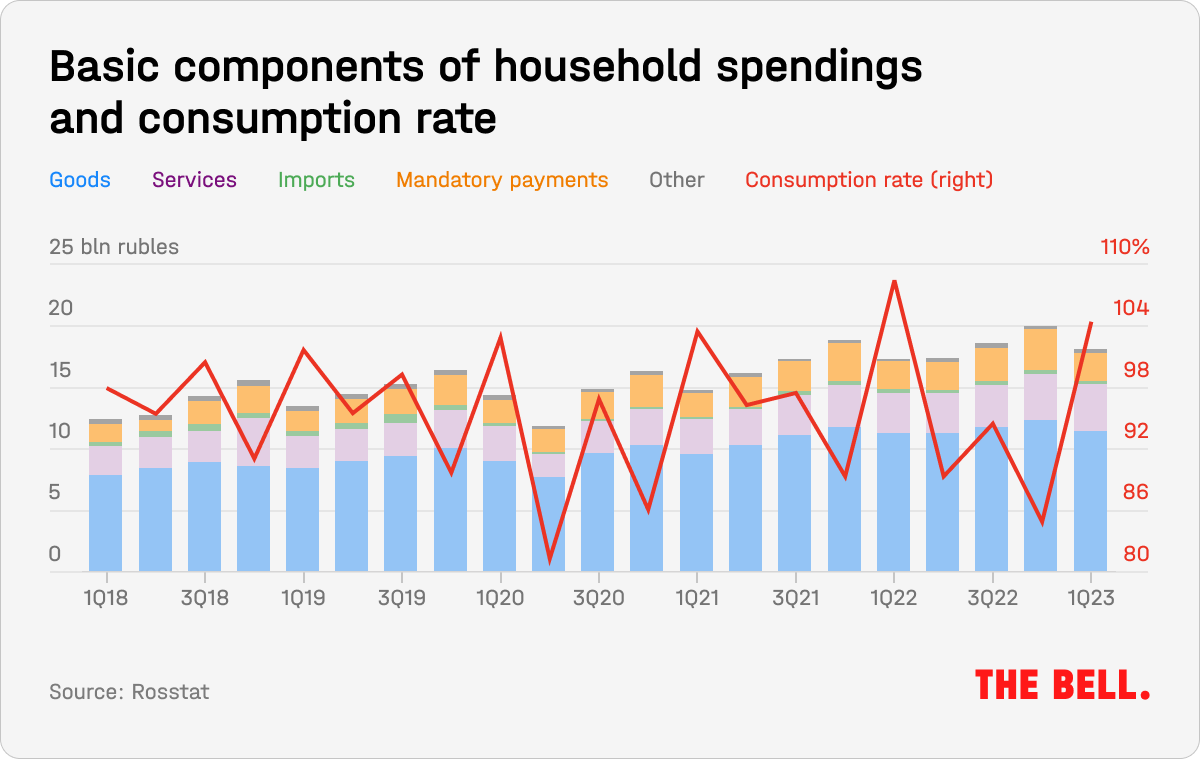

Russia’s economy remains on track to grow in the second quarter — driven by spending, private investment (primarily in import substitution) and consumer demand. At the same time, supply lags behind demand and the economy is in danger of overheating, Central Bank analysts warned in their latest “What the trends say” bulletin.

Consumer demand is fueled by increased salaries due to a labor shortage and a decline in uncertainty (you can read more about the labor market here). In such circumstances, people tend to spend, rather than save. For example, residents in Russia’s Central Federal District have reportedly been spending more than usual on durable goods like furniture and household appliances in the past three months. This revival is also aided by the reopening — under Russian ownership — of stores previously operated by departed Western brands.

Private sector investment is also on the rise, according to data and surveys. This is due to a combination of state financial support aimed at stimulating import substitution and the need to establish repair facilities and manufacture critical components. Russia’s private sector followed a similar strategy during Covid-19. Some businesses are having to replace equipment on a large scale as they reorient to new markets and suppliers.

Growth is also being helped by state orders. However, this only indirectly affects the total supply of goods and services for private consumption and investment through the creation of new business opportunities (for example, state infrastructure projects).

All this leads to intense competition for resources — labor, production, financial — within the economy. That is indicated by the record low unemployment rate and almost full utilization of production capacity, as well as high rates of corporate borrowing.

It’s because of this that the Central Bank analysts are wary of overheating in which domestic supplies of goods and services cannot keep pace with demand. As demand increases, prices will follow suit because supply cannot be increased. Slowing the pace of spending could ease the risk of overheating and eliminate the “overhang” on the demand side.

Why the world should care

Despite optimistic — and, arguably, unrealistic for a country at war — official figures, economic growth does not seem unsustainable. The economy is seeking a new balance. Right now, though, the situation is simple: when spending stops, growth will also stop.

Russian banks try payments in yuan

About 30 Russian banks have joined China’s CIPS (Cross-Border Interbank Payment System) which enables payments in yuan, Vedomosti reported. Thus far, most Russian banks are indirect participants rather than direct members: the latter have their own CIPS accounts and exchange messages through the system. Indirect users access the system via a direct partner, opening accounts via correspondent banks. Only Chinese-based organizations and their subsidiaries can be direct participants. The only Russian bank to connect directly to the Chinese system is a subsidiary of IBC Bank, China’s biggest, a source from a top-10 bank told Vedomosti.

Key figures

Weekly inflation in Russia to May 29 accelerated to 0.08% from 0.04% in the previous week, according to the State Statistics Service (Rosstat). Annual inflation accelerated from 2.36% to 2.41% and will continue to rise as the high base from 2022 moves out of the system.

Industrial output in April was up 5.2% year on year, Rosstat said. This is partly a reflection of last year’s low base and partly a result of increased mining. However, it is mostly due to an 8% increase in industrial production. The sharpest increases were in industries linked to the military (+30% in finished metal products, including weapons and ammunition). The defense sector has led growth for many months: in the first four months of 2023 alone it was up by 25%. Production of electrical equipment in April was up 29.3%, motor vehicles were up 27.3%, and computers and peripherals, optics and electronic products were up 23.8% (this includes military electronics and optics). Within these sectors, some product groups also showed dramatic growth: navigation systems (+60% y/y) or uniforms (+47%).

The average price for Urals crude oil from January to May 2023 was $51.50 a barrel, compared with $83.48 a barrel in the same period of 2022, the Finance Ministry said.

The average price for Urals in May was $53.34 a barrel, down from $78.81 in May last year.

The consensus from Central Bank surveys is increasingly optimistic:

- Analysts expect GDP to increase 0.8% in 2023, up from a projected 0.1% fall. There are no significant changes for 2024, where expectations drop slightly from 1.5% to 1.4%. Projections for 2025 are unchanged.

- Inflation in 2023 is now expected at 5.5% rather than 5.9%. There is no change in projections for 2024 and 2025The average price of Urals oil is now projected at $56 (-$4 from the April survey). In 2024 the price is expected to increase to $60 (-$4) and maintain that level through 2025 (-$2).

What to watch this week

Sectoral financial flow monitoring (Central Bank – June 9)

The Finance Ministry to announce the parameters of foreign exchange transactions under the budget rules (June 5)

Weekly inflation May 30 – June 5 (Rosstat — June 7)

Poverty data for Q1 2023 (Rosstat — June 7)

Further reading

Why Is the Russian Regime Ignoring the Moscow Drone Attacks? asks Tatiana Stanovaya

Alexandra Prokopenko (your author!) examines the impact of tech sanctions on the financial sector: Coping with Technology Sanctions in the Russian Financial Sector

Can China Compensate Russia’s Losses on the European Gas Market? asks Sergei Vakulenko

The author of this newsletter is one of Russia’s leading writers on this topic: independent economic analyst Alexandra Prokopenko. Alexandra worked as an advisor at Russia’s Central Bank and Moscow’s Higher School of Economics from 2017 to 2022 — and before that she was an economic journalist for Vedomosti, then Russia’s leading business newspaper. Today, Alexandra works as a researcher at Center for East and European Studies (ZOiS) in Berlin a non-resident scholar at the Carnegie Endowment for International Peace and a visiting fellow a the Center for Order and Governance in Eastern Europe, Russia, and Central Asia at the German Council on Foreign Relations. She holds an MA in Sociology from the University of Manchester.