Moscow attack: what we know so far

Hello! Welcome to your weekly guide to the Russian economy — written by Alexander Kolyandr and Alexandra Prokopenko and brought to you by The Bell. This week we look briefly at the breaking news of a major terrorist attack in Moscow, and then, in detail. at the economics behind the presidential election and how the Ukraine war disproportionately benefits Russia’s least well-off. We also look at Putin’s upcoming trip to China, and how Moscow’s dependence on Beijing – political and economic – is deepening.

The biggest terrorist attack in Moscow for 20 years

A group of armed people killed at least 115 people Friday in an attack on a shopping and entertainment center in Moscow – the most deadly terrorist incident in the Russian capital in two decades. Amid the war in Ukraine, Russia’s response is very difficult to predict.

- The attack began about 8 p.m. in Crocus City Hall, which includes one of Moscow’s biggest concert halls (seating about 6,200 people). Five well-armed people in camouflage entered the hall just before the start of a sold-out performance, shooting the security guards, and then those present in the room. According to officials, at least 150 people were killed and hundreds more injured. A large fire began at about this time, as a result of which part of the roof of the hall collapsed.

- Initially, there were reports that the attackers had remained in the building, but, at about midnight, the police announced they had begun a search for the culprits. On Saturday, the Federal Security Service (FSB) said that the four terrorists were detained in th western Bryansk region, which borders Ukraine. Russian state media posted videos of their interrogations; one of the attackers said that he was offered to carry out the shooting by a “preacher’s assistant” on messaging app Telegram, and was promised 1 million rubles ($11,000) as a reward.

- All the recent developments (especially the fact that the shooters were offered a money reward) and the tone of the propaganda, suggests that the Russian official version will inevitably focus on blaming Ukraine.

- The political backdrop is extremely concerning. President Vladimir Putin’s spokesman Dmitry Peskov said Thursday for the first time that Russia is waging a “war” in Ukraine – not a “special military operation,” which has been the preferred official term for more than two years, And the day before, Defense Minister Sergei Shoigu announced plans to establish three new armies – sparking speculation about another round of mobilization to raise the soldiers to man them.

Why the world should care

Such a brazen attack in the heart of Moscow could potentially be used by the Kremlin to justify another escalation in Ukraine, or another wave of mobilization. However, Russian officials stopped short of blaming Ukraine on Friday evening. We will look at the attack and its fallout in more detail in our following newsletters.

Wartime economics puts money in pockets of Russia’s poor

Predictably, Western nations were dismissive of the “election” that saw Vladimir Putin voted in for a fifth presidential term. Of course, the election was neither free, nor fair. However, that does not mean it was meaningless. The words once credited to U.S. political strategist James Carville also apply here: “It’s the economy, stupid.”

Even if the votes had been counted accurately, it's more than possible that the economy would have powered Putin to victory. After all, most Russians have never lived as well as they do now. Nor do people believe that things are about to get worse. This is particularly notable in Russia’s regions, far from the hipsters of Moscow and St. Petersburg.

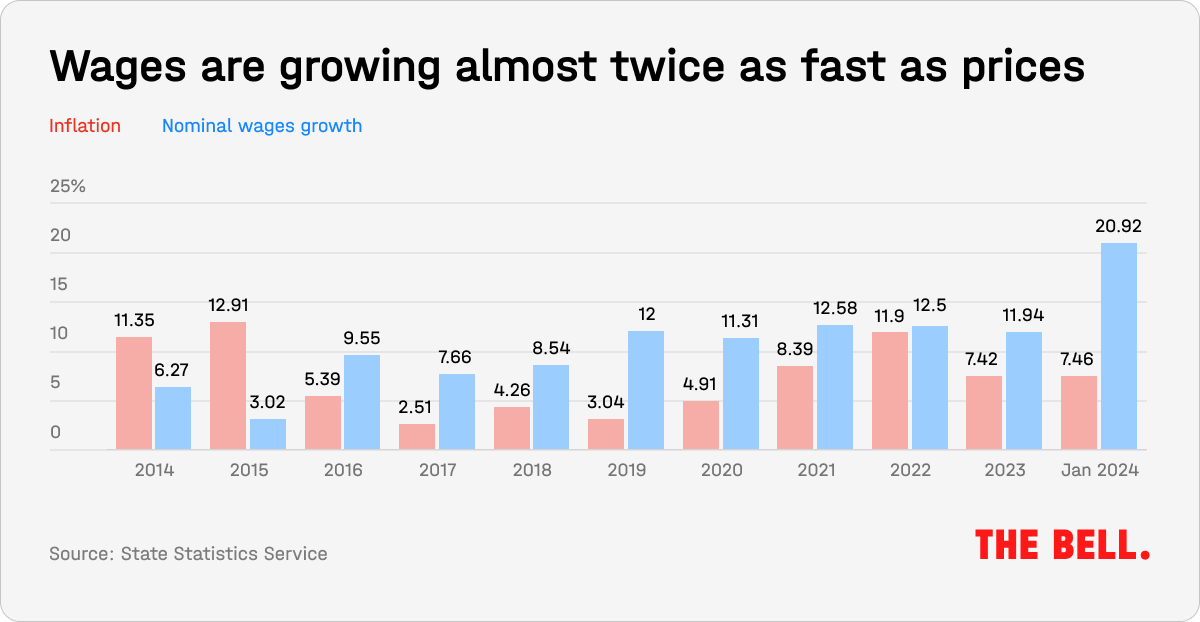

An economy that is growing because of the needs of the military and rising government spending has ensured wages outstripping inflation.

After the start of the war, inflation rocketed – but wages more than kept pace. Central Bank head Elvira Nabiullina said Friday that the economy’s “production capacity and labor reserves are almost totally committed.” In other words, there is no way of boosting production and the labor shortage is ongoing. That means salaries will continue to rise. Same the inflation.

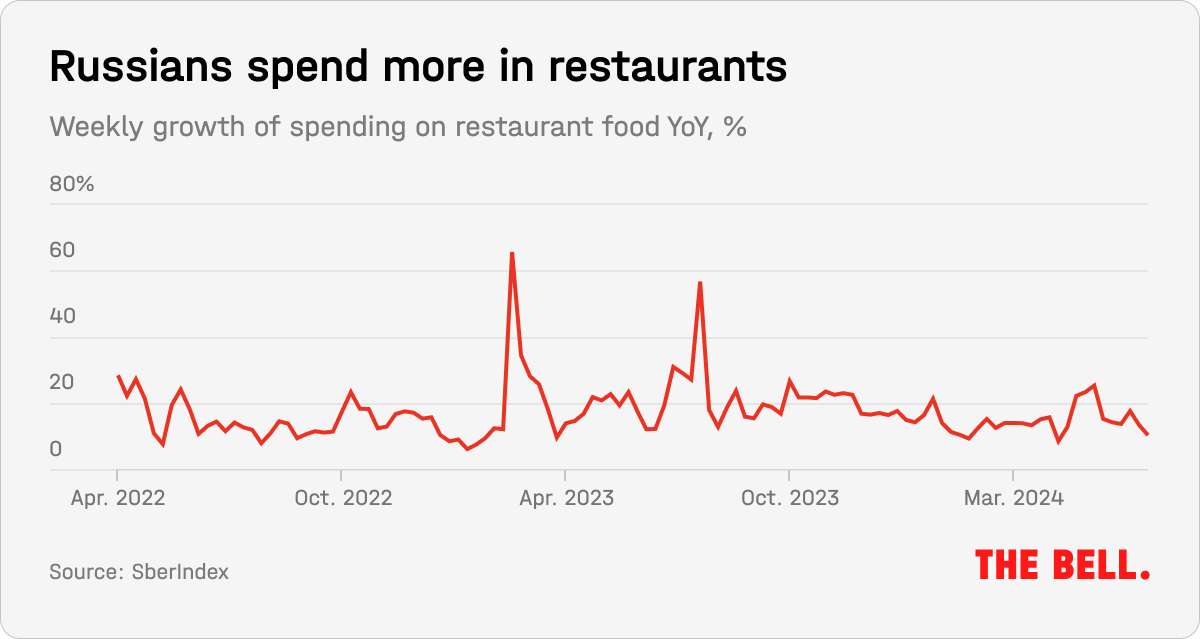

The fact that Russians are living better is evident from their outgoings. Spending at cafes and restaurants, for example, is increasing.

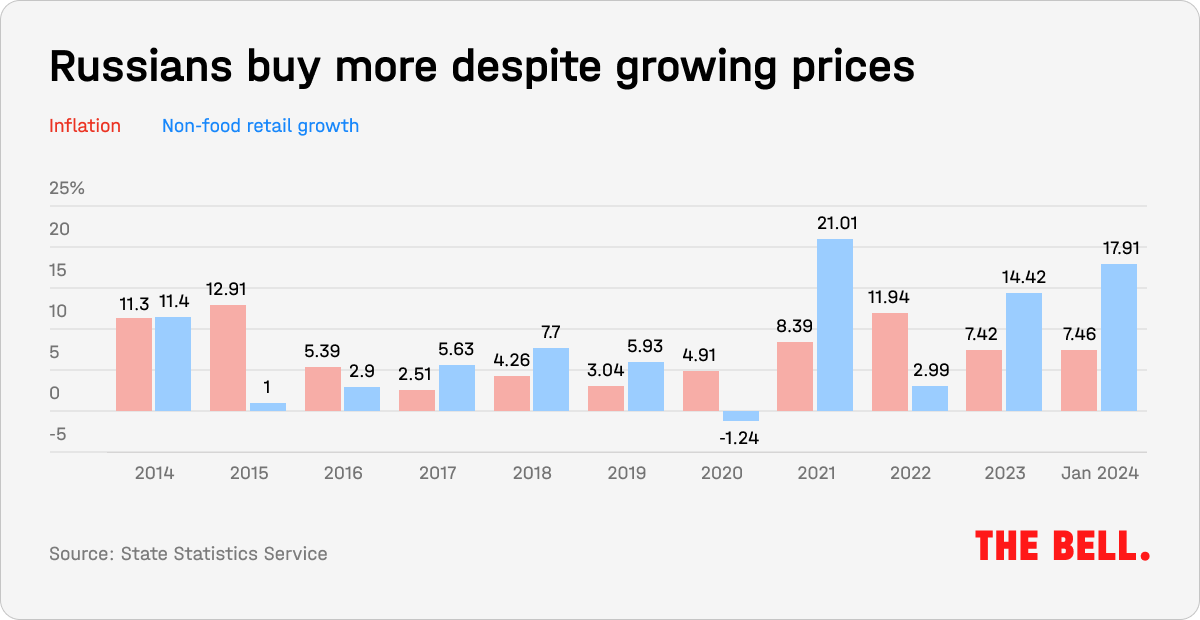

Demand for non-food goods (i.e. items where purchases can be postponed or even canceled) has recovered from its slump in the months after the full-scale invasion of Ukraine in 2022. Its rate of growth now exceeds both inflation, and wage increases.

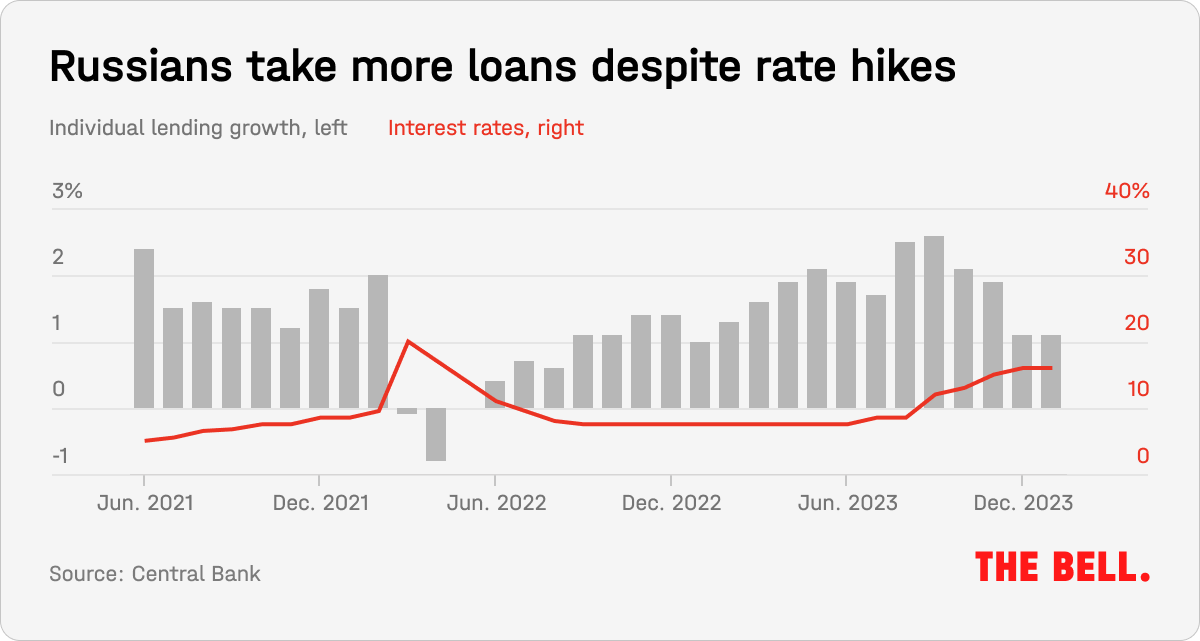

This does not look like the sort of panic buying that happens in a crisis, when many rush out to buy whatever consumer durables they can afford. Instead, Russians appear to have sufficient confidence in their finances to take out personal loans. Consumer confidence is approaching record levels, Nabiullina told reporters on Friday.

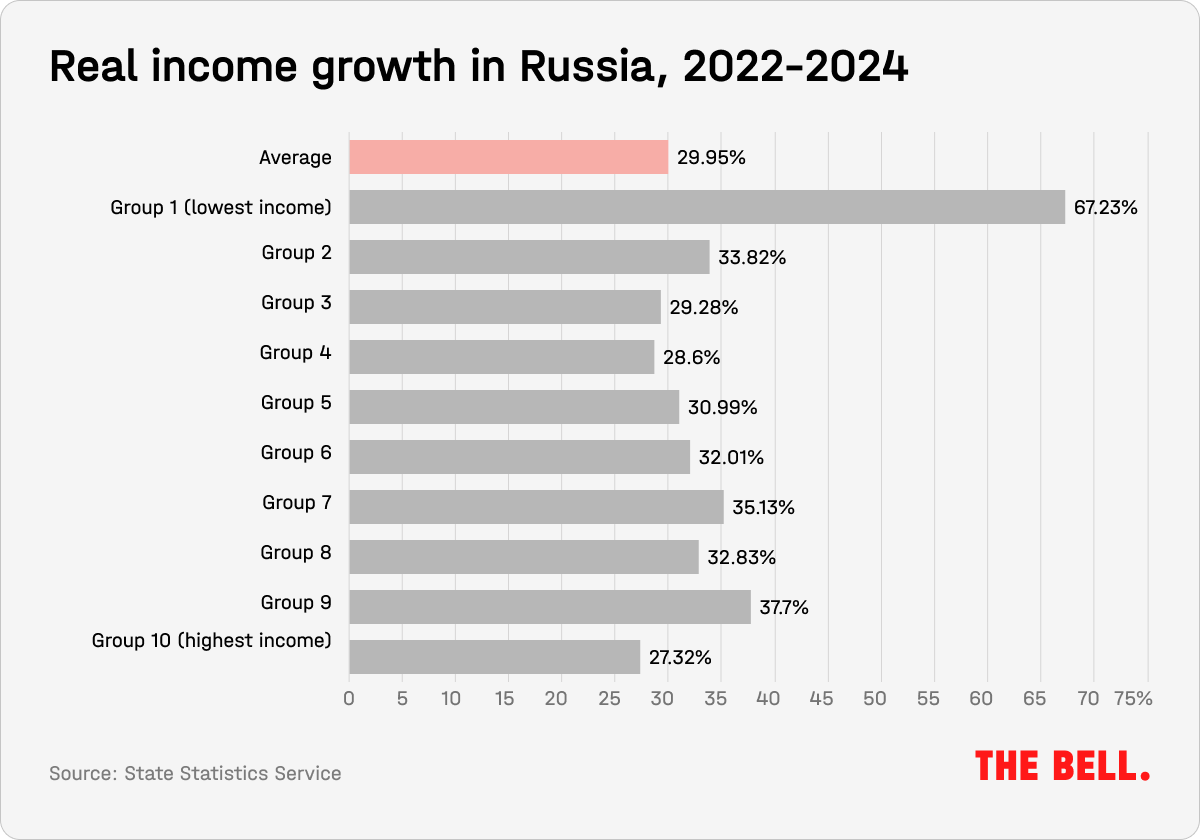

Of course, increased prosperity is not universal. But those who have lost out are the more wealthy Russians. The average income of the richest 10% in Russian society has increased by 27% since the start of the war. While this may seem a lot, it’s the lowest rise of all 10 income groups, and barely matches the combined inflation rate for the past two years. Incomes for the poorest in society have grown much faster.

“A large-scale redistribution of resources in favor of the less well-off has prompted a widespread shift in perceptions of justice for the first time since 1990,” Denis Volkov, director of independent pollster Levada Center, wrote in an article last month. According to Levada, the proportion of Russians who feel that the distribution of material wealth in Russia is getting more unfair fell from 45% in 2021 to 25% in November 2023.

Why the world should care

The war has caused disproportionate economic suffering for a small minority of privileged Russians living in big cities, working for international companies (or companies integrated into global networks) and regarding themselves as “citizens of the world.” The Kremlin has apparently given up on this group. Now, Russian citizens who once regarded themselves as forgotten and overlooked are ready to take their place. Both the war, and the Kremlin’s economic policies, resonate in the hearts and wallets of these people.

Putin Prepares For China Visit as Russia’s Dependence Grows

Putin’s first foreign visit after his upcoming inauguration could be to China. The Russian president could head eastward as soon as May, Reuters reported Tuesday. The increasing regularity of meetings between Putin and his Chinese counterpart, Xi Jinping, is testament to the rapidly deepening ties between the two countries.

- Putin and Xi met twice last year. In March, the Chinese leader came to Moscow. Then, in October, Putin made a visit to Beijing for the Belt and Road Forum. The Russian leader’s next trip would likely be a mirror of Xi Jinping’s Moscow visit.

- Since the full-scale invasion of Ukraine, Russia’s relationship with China has begun to look a lot like dependence. Western sanctions are pushing Moscow into Beijing’s embrace, with Sino-Russian trade last year topping $240 billion (China delivered 38% of Russia’s imports, and received 31% of Russian exports). Beijing now holds a monopoly in a range of goods (and, as a result, can charge Russia more than other countries).There was a 594% increase in imports of Chinese cars to Russia in 2023, and an almost 600% increase in imports of Chinese tractors.

- China is not just Russia’s leading trade partner. It also plays a key role in helping settle accounts with third countries. In just two years, the yuan has become the most important currency for Russian business. In December, 35.8% of Russian exports and 37% of imports were paid for in yuan. That’s more than the ruble (35.7% and 31.5% respectively). The amount of yuan held in Russian business and personal accounts last year even outstripped the U.S. dollar ($68.7 billion vs $64.7 billion). And lending to companies in yuan was up 3.6 times to $36.1 billion in 2023, primarily due to the conversion of debts once held in U.S. dollars and euros.

- Some media outlets speculated that one of Putin’s reasons for visiting China was to solve the problems some Russian financial institutions had with Chinese banks last year. The issues seemed to arise after U.S. President Joe Biden passed a decree tightening the penalties on third parties helping Russia evade Western sanctions. However, this speculation is probably little more than speculation. It's true that correspondent banks in China began curtailing relationships with their Russian counterparts after the U.S. decree, and businesses complained of problems. But this did not halt financial transactions. “In general, payments were made and continue to be made,” a source from a Russian export company told The Bell. “It’s just that first-tier banks are being replaced by second and third-tier organizations.”

- The average time to verify funds received from Russia in China is now 18 days, according to the “Business Practice in China” Telegram channel. In other words, payment chains are adapting to new realities. “Before, the relationship was: client – Russian bank – foreign bank – client. Now, there are three or five more banks in the chain. But everything still works,” added The Bell’s source.

Why the world should care

Right now, China is Russia’s biggest political supporter on the international stage. But it is hugely important for the Russian economy. Without Chinese goods, and China’s willingness to buy Russian hydrocarbons, Russia’s economy would be in a much worse state.

Figures of the week

- The Central Bank left interest rates unchanged at 16% after a scheduled meeting Friday. Officials said that, while Inflationary pressures are easing, they remain high, and domestic demand continues to outpace the capacity to expand production. All the indicators are that the Russian economy is continuing to grow rapidly this year, after recording 3.6% growth in 2023. Growth in corporate and mortgage lending has slowed in recent months, according to the Central Bank, but there has been an acceleration in unsecured consumer lending. There appears unlikely to be any softening of the Central Bank's rhetoric in the near future.

- Expobank bought HSBC's Russian subsidiary at a 90% discount, according to media reports Thursday. The deal may be worth about 2 billion rubles.

- Weekly inflation in Russia accelerated slightly to 0.06% in the week beginning March 12. Annual inflation slowed from 7.6% to 7.58%. Food prices fell by 0.12% (primarily due to a sharp drop in the prices for fruit and vegetable products, which declined 1.34%).

Further reading

Russia’s 2024 Election Has Established New Voting Standards by Andrey Pertsev

Transnistria’s hybrid rebuke to Moldova’s reintegration agenda